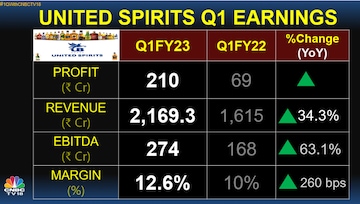

Diageo-controlled liquor maker United Spirits Ltd (USL) on Tuesday reported a 204 percent year-on-year (YoY) jump in net profit at Rs 210 crore for the first quarter ended June 30, 2022, on strong consumer demand.

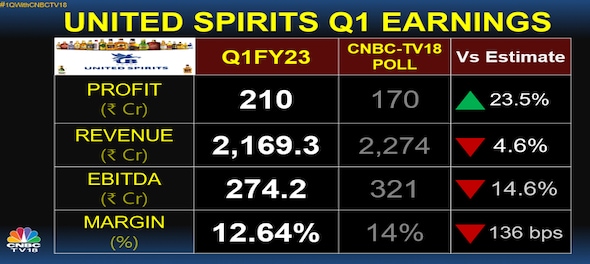

In the corresponding quarter last year, the company posted a net profit of Rs 69 crore. CNBC-TV18 Polls had predicted a profit of Rs 170 crore for the quarter under review.

Its revenue from operations stood at Rs 2,169.3 crore during the period under review, up 34.3 percent against Rs 1,615 crore in the corresponding period of the preceding fiscal.

Also Read:

At the operating level, EBITDA jumped 63.5 percent to Rs 274.2 crore in Q1 FY23 over Rs 168 crore in Q1 FY22. EBITDA margin stood at 12.6 percent in Q1 FY23 as compared to 10.4 percent in Q1 FY22. EBITDA is earnings before interest, tax, depreciation and amortization.

USL's total expenses were at Rs 6,864.6 crore, up 12.91 percent in Q1/FY 2022-23, as against Rs 6,079.7 crore.

Its net sales increased "lapping a soft prior year comparator, with growth driven by resilient consumer demand in the off-trade and recovery of the on-trade," said USL in an earning statement.

Net sales increased 34.3 percent in the quarter. Net sales of the Prestige & Above segment increased 43.7 percent while net sales of the Popular segment increased 13.1 percent, the company said. Overall volume increased 17.9 percent with a growth of 24.9 percent in the Prestige & Above segment, outpacing the popular volume expansion of 10.7 percent.

"On a reported basis, staff costs were 7.7 percent of sales, down 393bps. Other overheads were 14.2 percent of sales, down 327bps due to improved operating leverage on fixed costs," it said.

Commenting on the results, Diageo India CEO Hina Nagarajan said: "Our business today is ahead of pre-pandemic levels, substantiating the resilience of our category." Double-digit inflation, scotch supply constraints in select markets and a one-time special grant to its employees, impacted the EBITDA margin delivery, she added.

Over the outlook, Nagarajan said looking ahead, in the shorter term, she expects inflationary pressures to continue. "Our confidence in the medium to long-term prospects of our industry, the resilience of our business, and our ability to navigate headwinds remains high," she added.

The results came after the close of the market hours.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election Phase 2: Experts decode the key trends and issues in key battleground states

Apr 26, 2024 11:53 PM

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM