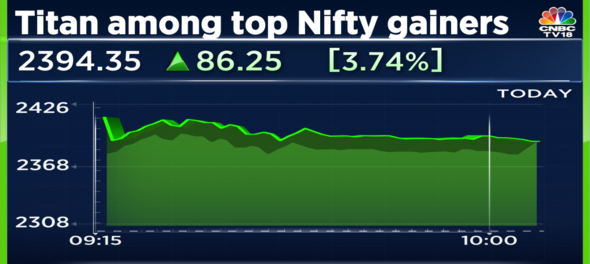

Titan shares climbed up 5 percent in early morning trade after strong performance in revenue growth for the October-December quarter. At 10:10 am shares of Titan were trading at Rs 2,398 up by 4.05 percent from the previous close on the BSE.

Tata Group’s Titan reported a 3.6 percent decline in standalone profit for the October-December quarter. The company’s net profit for the quarter stood at Rs 951 crore as compared to Rs 987 crore in the corresponding period a year ago.

Total income (standalone) came at Rs 10,651 crore increasing 12 percent from Rs 9,516 crore in the quarter ended December 31, 2021.

Titan’s profit margin was primarily affected due to rise in expenses and 6 times higher gold ingot sales in the third quarter of financial year 2023. The company’s total expenses came at Rs 9,699 crore increasing 13.7 percent from Rs 8523 in the corresponding period a year ago.

The company also sold gold ingot worth Rs 315 crore in the quarter as compared to the sale of the same worth Rs 54 crore in the corresponding period a year ago, as notified by Titan in a business update.

Gold ingots are basically gold bars. Jewellery companies use gold ingots to preserve gold to make gold jewellery. They are technically raw material for the company hence there is no profit margin on its sale.

How did all the business under the Titan Company perform?

Titan’s jewellery business recorded a growth of revenue growth of 14.1 percent in the quarter at Rs 9,833 crore. Earnings Before Interest and Taxes (EBIT) declined 1.96 percent and came at Rs 1,236 crore.

The company's India business grew by 9 percent in the same period, backed by healthy consumer demand during the festive season. The customer walk-ins were robust and consumer preference for differentiated designs were prominent across categories, Titan said in its financial results for the quarter.

The watches and wearables business witnessed a revenue growth of 42.5 percent. Buoyed by new product launches, the business reported an EBIT of Rs 89 crores clocking an EBIT margin of 11 percent.

The eyecare/eyewear business grew 12 percent. Titan reported an EBIT of Rs 32 crore, clocking an EBIT margin of 18.4 percent. The company also opened its first international store in Dubai in December 2022.

Caratlane continued to contribute 75 percent of the total business to the company. The total Income for Caratlane grew by 51 percent as compared to the corresponding fiscal, to Rs 677 crore, driven by gifting campaigns around the festive season, Titan said in the regulatory filing.

Shares closed at Rs 2,304, or down 1.8 percent, from the previous close on the Bombay Stock Exchange (BSE).

First Published: Feb 2, 2023 4:29 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna Sexual Assault Case: Activist raises concerns over political interference, delayed investigation in the matter

Apr 30, 2024 10:17 PM

Lok Sabha Election 2024: Baramati election outcome will decide the future of Pawar dynasty, says expert

Apr 30, 2024 10:08 PM

Lok Sabha elections 2024: Baramati to Mainpuri, key battles in phase 3

Apr 30, 2024 7:01 PM