The third quarter earnings season for the information technology (IT) sector kickstarted with industry leaders Infosys and Tata Consultancy Services (TCS) on Thursday (January 11) followed by Wipro and HCL Technologies on Friday.

The December quarter is typically a seasonally weak period for this sector but the

large-cap IT companies have beaten the low forecasts. Expectations were running low due to seasonality, weak macros and the cut in discretionary spending, but the companies did fairly well despite it being a difficult quarter.

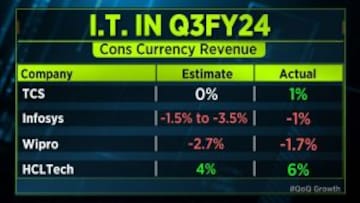

All four IT companies topped what the Street was anticipating.

HCLTech led the pack with a 6% topline growth aided by large deal ramp-up and an acquisition. TCS reported a 1% revenue growth against estimates of low growth. Infosys and Wipro saw a revenue contraction, but not as much as what the Street feared, in the third quarter.

The margin performance has also been strong — three out of the four companies have reported a margin beat, including TCS, Wipro and HCLTech. For TCS, margins have expanded for the second consecutive quarter, improving by nearly 70 basis points (bps) on a quarter-on-quarter (QoQ) basis.

Wipro has managed to hold margins at 16% band despite a wage hike impact. HCLTech has clocked in a solid margin expansion of 130 bps at 19.70%.

FY24 guidance

Both HCLTech and Infosys have narrowed their full-year growth forecast. Infosys is now likely to end the year with a 1.5-2% revenue growth for the full-year, while for HCLTech the upper end of the guidance band from 6% was brought down by 50 bps and the company is going to see 5-5.5% revenue growth.

Other noteworthy highlights include:

Deal wins have been steady. One has to account for the seasonality, broadly speaking, deal wins are steady.

Attrition for most companies are now at a multi-year low. Sectors where there was pressure include financials, communication and hi-tech. while manufacturing clocked good growth.

It has also been a good start to the year for most of the IT companies, with companies rallying anywhere between 5-10% since the beginning of 2024, taking their one-year rally to almost 45-50% for the likes of HCLTech.

The question from now is on valuations. After HCLTech’s outperformance in the last one year, its valuations are coming very close to that of Infosys. According to Kotak Institutional Equities estimates, HCLTech is at 24 times forward multiple, while Infosys is at 25 times forward multiple and these companies are likely to report an EPS of about 10-11%.The large-cap IT companies seem to have done their bit in terms of helping with the Q3 earnings season.

(Edited by : Shoma Bhattacharjee)