The chemicals industry is largely expected to see an improvement on a quarter on quarter (QoQ) basis due to pick up in exports this time. However, there could be muted performance year on year (YoY) in some cases due to weak global demand environment in terms of raw material costs.

Basic Chemicals have seen a decline in prices as crude prices have fallen 8 percent on a sequential basis. For Oleochemical, it is down 20 percent on sequential basis. Ocean Freight costs are down anywhere between 40 percent and 50 percent.

But demand pressures will continue in discretionary sectors like dyes and pigments, polymers etc. something that companies have indicated.

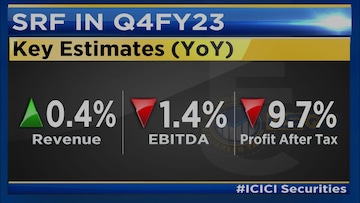

In the fluorochemicals space, sustained high price in refrigerant gases will aid earnings, however there will be weakness in packaging textiles business. This is for SRF in particular, and that's where revenue will be flat, EBITDA and profits will be down for the company.

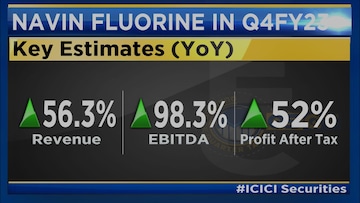

However, for Naveen Fluorine, earnings will be aided by improvement in high performance products and chemicals segment leading to 56 percent revenue, 98 percent EBITDA and 52 percent profit after tax (PAT) growth.

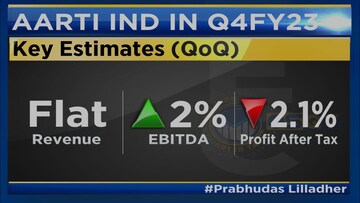

For Aarti Industries, which recently saw demerger of the pharma business, incremental revenue from new capex is expected only in FY24 and that's why revenues are flat in quarter four, EBITDA will be expected to go higher by two percent. But profit after tax is expected to decline two percent.

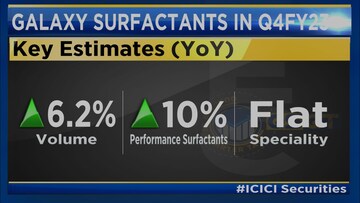

For Oleochemicals player Galaxy Surfactants, it will be a steady performance after some weakness that has been seen. Volumes are expected to grow 6 percent, out of which Performance Surfactants will do well, up 10 percent but speciality, which is the high margin product, will be flat.

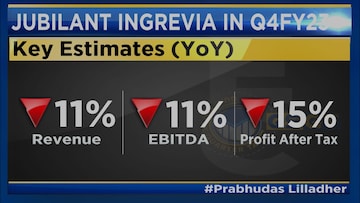

For Jubilant Ingrevia, metrics will be weak down between 11 percent and 15 percent. This is of course on a high base.

Acetic acid, which is the key raw material, has seen a 40 percent decline in pricing, which will lead to lower revenue as well.

Generally active ingredients saw a decline and that's why performance will be weak.

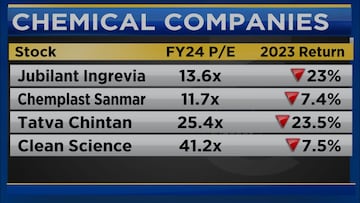

In terms of valuations, barring few, these stocks have underperformed. So SRF, Naveen Fluorine have been up anywhere between eight percent and 16 percent. Valuations for Naveen Fluorine are way higher at 45 times, Galaxy Surfactants is up 3.5 percent with valuations around 23 times, Aarti Industries is also on the lower side.

Newer listings like Tatva Chintan, Clean Science, Chemplast - all are down between seven percent and 23 percent and valuations are ranging anywhere from 13 and a half times for Chemplast to 40 times for Clean Science.

Rohan Gupta, Director at Nuvama Institutional Equities has a positive view on the sector.

“Overall our view on the sector is very positive. I believe that from quarter one to quarter two, there should be continuous improvement across the chemical sector,” he said.

For more details, watch the accompanying video