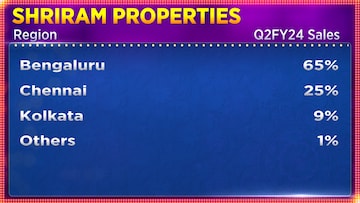

Bengaluru-based real estate player, Shriram Properties expects a 'substantial rise' in property prices after the 2024 general elections. The company's Chairman and Managing Director, M Murali, discussed these projections with CNBC-TV18.

Murali anticipates a 5-10% increase in prices in the latter half of the year, following a 14% hike in the first half compared to the previous year.

Last week, Pavitra Shankar, Managing Director of Bengaluru-based Brigade Enterprises also pointed out to CNBC-TV18 that the company has been

able to successfully increase prices without affecting buyer interest.

The real estate boom in India has been attracting investments from non-resident Indians (NRIs) as well, and the preferred destinations are Bengaluru and Mumbai.

According to a recent

real estate report by tech-based brokerage platform, NoBroker, "More NRIs purchasing houses in India. The growth in NRI residential sales, which has risen from 11% to 15%, in a matter of months, underscores this point. This demand is slated to reach 20% by the end of 2025."

The report stated that over the past year, there has been a remarkable increase in the interest and involvement of NRIs in the Indian real estate market.

"With its cosmopolitan lifestyle, world-class educational institutions, and a thriving startup ecosystem, the rental yield of Bengaluru has gone up substantially, making it a good investment destination," the report stated.

NRI investments in Bengaluru and other cities are believed to be primarily coming from the United Arab Emirates (UAE), including Dubai, and from Western countries such as the US and the UK, per a Moneycontrol report that quoted Ashish Sharma, city head for Bengaluru at the ANAROCK Group.

Experts also believe that volatile market conditions following the Israel-Hamas conflict and rising real estate prices are also leading to a flight of funds from Dubai to cities such as Bengaluru, Pune, and Hyderabad.

Knight Frank India data suggests investments from Dubai into India from 2018 to 2022 touched $2.7 billion, with $565 million coming in last year.

Shriram's M Murali also talked about the company's financials. He said the company's net debt stands at about ₹430 crore and the gross debt is at ₹500 crore. He hopes to generate close to ₹300 crore in free cash flow over the next few years. "This influx of funds will significantly contribute to debt reduction, especially as these debts are tied to construction finance, and as projects reach completion, the debts are repaid," he noted.

Also Read

In the September quarter earnings released on November 10, Shriram Properties reported a net profit of ₹20.2 crore, a marginal 3% increase from the previous year. However, revenue declined 16% decline to ₹231.3 crore from ₹275.9 crore in the same quarter last year.

The company's market capitalisation stands at ₹1,804 crore.

For more details, watch the accompanying video

(Edited by : Shweta Mungre)

First Published: Nov 13, 2023 4:57 PM IST