SBI Life Insurance on Friday reported a 53 percent jump in second-quarter profit on Friday, helped by a rise in premiums and as its value of new business grew. Insurance penetration has traditionally been low in India, but that is slowly changing, especially as more people rushed to buy new policies after the pandemic.

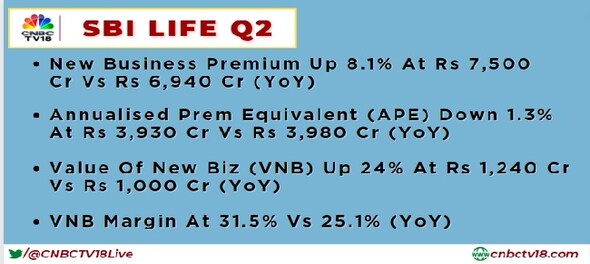

The new business premium increased by 8.1 percent at Rs 7,500 crore versus Rs 6,940 crore year-on-year.

The annualised premium equivalent (APE) was 1.3 percent down at Rs 3,930 crore versus Rs 3,980 crore year-on-year. The value of new business (VNB) was 24 percent up at Rs 1,240 crore versus Rs 1,000 crore year-on-year.

The VNB margin stood at 31.5 percent versus 25.1 percent year-on-year.

VNB margin indicates the profit margin of life insurance company. It is calculated by dividing the Value of New Business by Annualized Premium Equivalent (Regular Premium +10 percent of Single Premium).

"The company has maintained its leadership position in Individual Rated Premium of Rs 60.5 billion with 23.7 percent private market share in H1 FY 23," SBI Life said in an exchange filing.

Its assets under management (AUM) rose by 16 percent year-on-year (YoY) to Rs 2,826.3 billion in Q2 with a debt-equity mix of 71:29. The insurer's protection individual new business premium registered a growth of 17 percent and stood at Rs 434 crore in Q2.

Its VoNB Margin increased by 630 bps to 31 percent, it said.

The company’s net worth increased by 12 percent from Rs 109.1 billion as on September 30, 2021 to Rs 122.1 billion as on September 30, 2022. The robust solvency ratio stood at 2.19 as on September 30, 2022 as against the regulatory requirement of 1.50 indicating strong financial position of the company, SBI Life Insurance said.

First Published: Oct 21, 2022 5:36 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM