The life insurance sector appears poised for impressive growth, with a strong focus on specific segments, according to Madhukar Ladha, Director, Nuvama Institutional Equities.

In terms of product mix, for the life insurers, the growth is driven more by Unit Linked Insurance Plans (ULIP) as that market is doing well, he said in an interview with CNBC-TV18.

“What will be important to see will be how individual protection is growing and whether non-par products are holding up in the share given that interest rates have moved higher for other products,” he said.

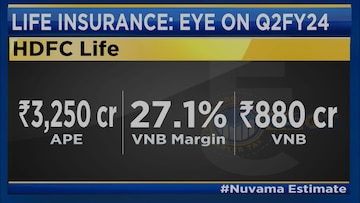

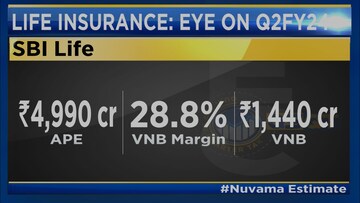

The aggregate value of new business (VNB) is forecasted to grow by 13.5% year-on-year (YoY). Simply put, VNB is the estimated worth of profits from newly sold policies.

He also expects the VNB margin to rise 136 basis points (bps) year-on-year rise to reach 28.3%.

According to him, the Street does expect slightly muted margins on a YoY basis.

On the stock of

HDFC Life, which has been subdued for a while now, he said, “It is still a rock solid company. They are the product innovation leaders in the market. The brand inspires a lot of confidence and faith from buyers of their products. So still the company is pretty good. Having said that, what will be a key monitorable is after it has become a subsidiary of HDFC Bank, how much more support can it get from the bank.”

HDFC Bank's sales distribution among Tata, Birla, and HDFC Life currently leans towards HDFC Life, accounting for approximately 55-57%. Analysts anticipate a significant increase in this proportion. If this projection materializes, it could result in a stock reevaluation, as he elaborated.

However, his top pick from the sector would be SBI Life.

“My top pick would be

SBI Life. On a valuation basis as well as the growth that they are showing and margins that they have, I like SBI Life the most right now,” he said.

For more details, watch the accompanying video

(Edited by : Shweta Mungre)