The oil and gas industry has been buzzing with anticipation as companies prepare to release their quarterly earnings. While the sector faces challenges such as lower crude oil prices and declining refining margins, there are pockets of growth that offer hope.

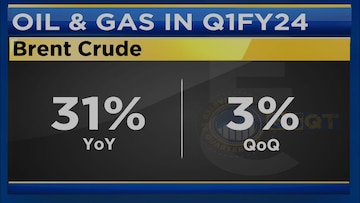

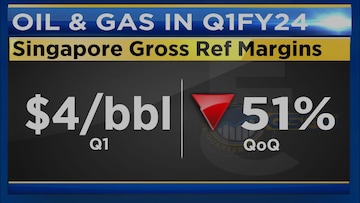

Reliance Industries Ltd (RIL) is expected to experience a decline in refining earnings due to lower Brent crude prices and a significant drop in Singapore's gross refining margins (GRMs). Brent crude prices have fallen by 31 percent year-on-year and 3 percent sequentially, currently standing at $78 per barrel.

Consequently, RIL's EBITDA is projected to decrease by 2 percent sequentially and 1 percent year-on-year.

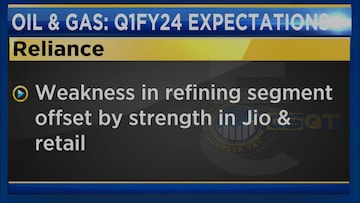

However, the company's diversified portfolio, including its Jio and retail divisions, is expected to offset the weakness in refining.

Upstream companies like Oil and Natural Gas Corporation (ONGC) and Oil India Ltd (OIL) are anticipated to witness an 8 percent decline in EBITDA on a quarter-on-quarter basis.

This trend is primarily driven by lower gas prices, as the government has capped domestic gas prices at $6.5 per barrel, down from $8.7 per barrel previously. Additionally, reduced crude oil realisations will impact earnings for these companies.

Despite the overall decline in the refining segment,

oil marketing companies (OMCs) are expected to be star performers in this quarter. Their marketing segments are anticipated to report over-recoveries, mitigating the effects of the weak refining segment.

Petrol and diesel margins ranging from Rs 8 to Rs 9 per liter will be a driving force for these companies. While refining weaknesses persist, OMCs are projected to maintain a sequential decline in gross refining margins (GRMs) between $7 and $9.9 per barrel. Nevertheless, OMCs' EBITDA and PAT are expected to show improvement on both a year-on-year and a quarter-on-quarter basis.

City gas distribution companies (CGDs) such as Indraprastha Gas Ltd (IGL) and Mahanagar Gas Ltd (MGL) are expected to experience a favorable quarter due to lower domestic gas costs.

Gujarat Gas is anticipated to benefit from low spot LNG prices, with margins and volumes projected to recover, leading to a 19 percent increase in EBITDA and a 25 percent rise in profits.

Gas utilities companies, including GAIL and Petronet LNG, are also expected to have a strong quarter. GAIL's weak performance in the previous quarter is expected to rebound, with a tenfold increase in EBITDA on a quarter-on-quarter basis. Petronet LNG is likely to benefit from declining spot LNG prices, positively impacting its earnings.

Reliance Industries is currently trading at 23.6 times its valuation, while PSU companies such as ONGC, Indian Oil Corporation (IOC),

Bharat Petroleum Corporation Ltd (BPCL), and Hindustan Petroleum Corporation Ltd (HPCL) trade at lower valuations, ranging from three to five times. City gas companies have valuations between 12 and 22 times, with MGL being the most attractively priced among them.

According to Probal Sen, energy analyst at ICICI Securities, Petronet LNG is expected to benefit from the softness in spot LNG prices. Sen also expressed bullish sentiment towards OMCs, highlighting a positive outlook on the sector for the past month and a half.

Regarding Reliance Industries, Sen maintained a fair value estimation of around Rs 2,700-2,750 per share. For the retail division, he estimated a value of approximately Rs 700-800 per share.

For more details, watch the accompanying video