Reliance Industries Ltd (RIL) reported consolidated revenue of Rs 2.3 lakh crore for the July-September period, up 5 percent compared with the previous quarter and in line with Street estimates.

The conglomerate's net profit came in at Rs 13,656 crore for the three-month period, down 23.9 percent sequentially owing to pressure in its oil-to-chemical (O2C) business.

Reliance's consolidated EBITDA margin — a key measure of profitability — came in at 13.6 percent for the September 2022 quarter, according to a regulatory filing.

Revenue from the company's oil-to-chemical unit came in at Rs 1.6 lakh crore for the September quarter, as against Rs 1.61 lakh crore for the April-June period. Reliance's operating margin in the O2C business stood at 6.1 percent.

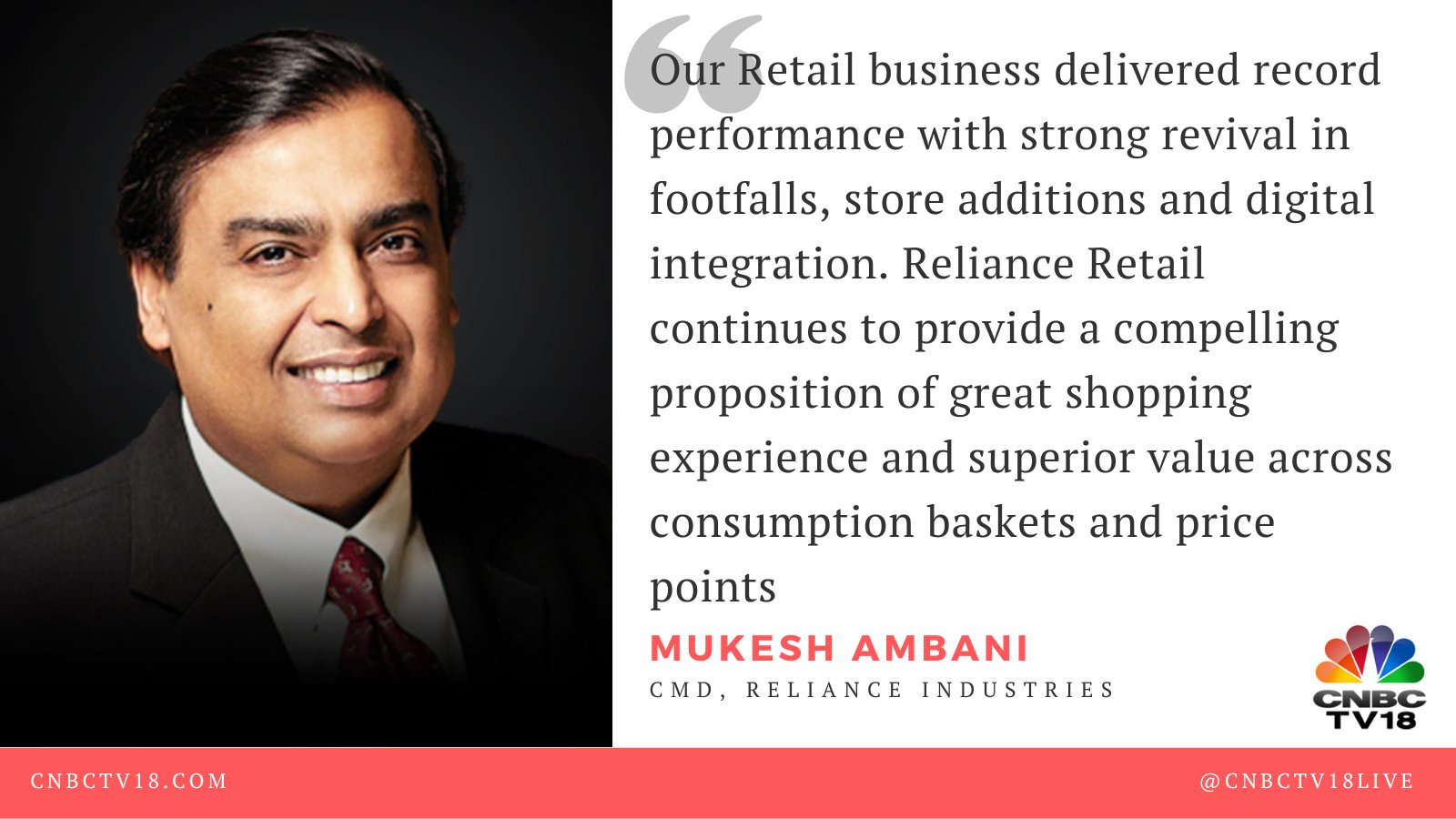

"The performance of our O2C business reflects subdued demand and a weak margin environment across downstream chemical products. Transportation fuel margins were better than last year but significantly lower sequentially," said Mukesh D Ambani, Chairman and Managing Director of Reliance Industries.

The O2C business accounted for almost 57 percent of Reliance Industries' total revenue in the year ended March 2022.

"Segment performance was also impacted by the introduction of special additional excise duties during the quarter to ensure stable supply and lower volatility in the domestic market," he said.

Revenue from Reliance's oil and gas business increased 6.3 percent to Rs 3,853 crore compared with the previous quarter. The operating margin from the unit improved to 65 percent from 58 percent sequentially.

The company reported strong numbers from its consumer-facing businesses — Reliance Retail and Jio Platforms — on the back of robust footfalls and subscriber addition.

Friday's earnings report is the company's first since its 45th annual general meeting in June, where the Chairman detailed the succession plan at India's most valuable firm.

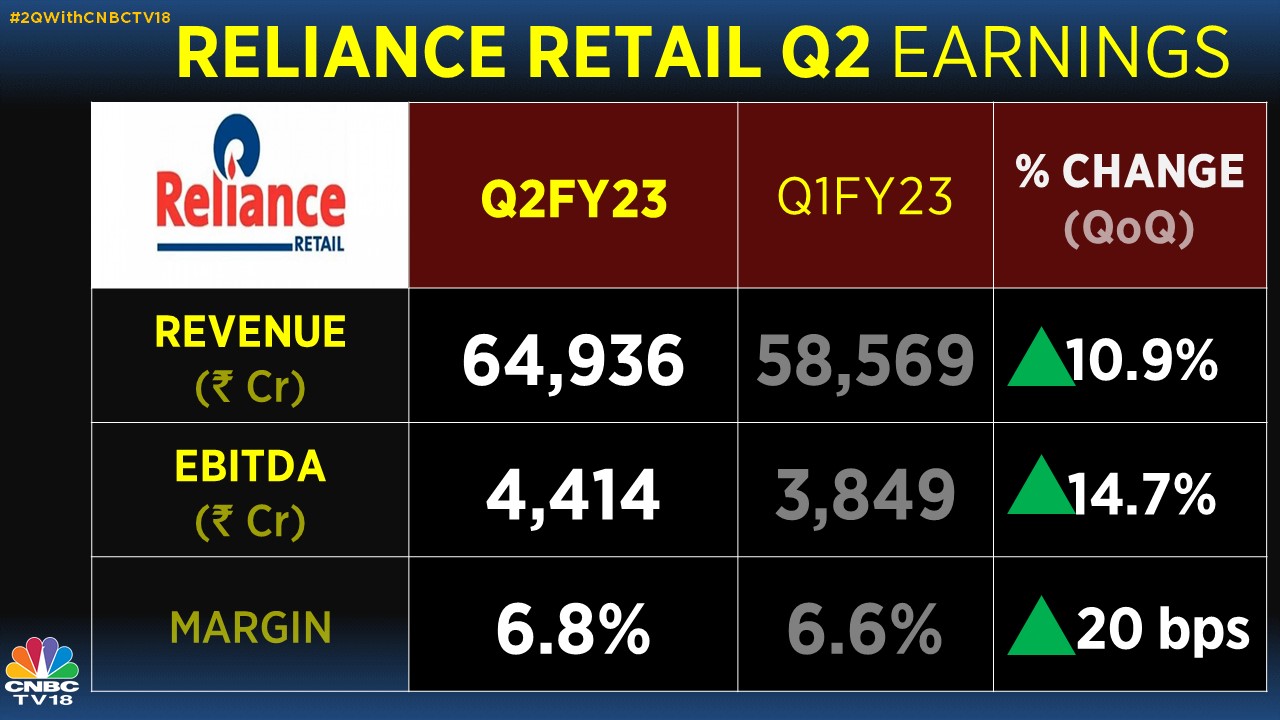

Revenue from Reliance Retail — Reliance Industries' retail arm — jumped almost 11 percent sequentially to Rs 64,936 crore. Its margin improved by 20 basis points to 6.8 percent for the three months.

The retail arm's numbers surpassed brokerage estimates. Growth in the topline was led by a revival in footfalls, store additions and digital integrations.

Reliance said the quarter was marked by an operating environment at par with pre-COVID levels. Consumer sentiments remained positive across town classes on the back of key promotional events and an early onset of festivities, the conglomerate said in a statement.

Reliance Jio's net profit increased 4.2 percent to Rs 4,518 crore for the quarter. The telecom firm's margin and revenue grew for the third consecutive quarter, while the average revenue per user (ARPU) grew for the sixth consecutive quarter due to a better subscriber mix.

Reliance's numbers are more or less on expected lines, Deven Choksey of KR Choksey Holdings told CNBC-TV18.

"Fortunately, the Jio and retail numbers are actually more robust compared to the O2C part of the business... Consumer-facing businesses are definitely showing a remarkably good amount of resilience," he said.

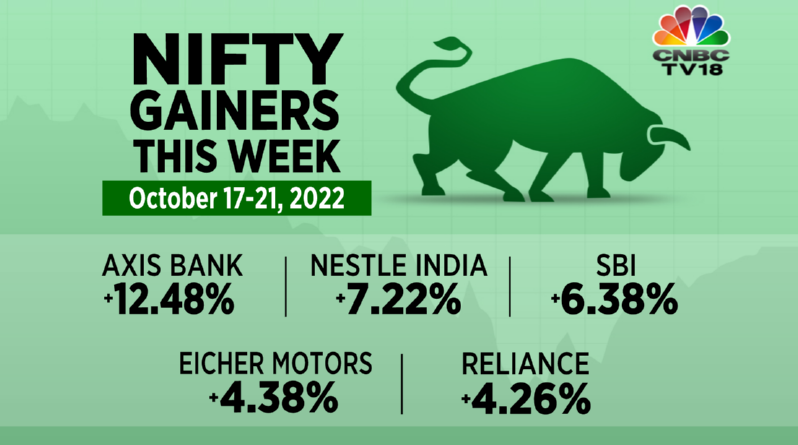

Reliance shares rose 4.3 percent for the week ahead of the earnings announcement, a period in which the benchmark Nifty50 index gained 2.3 percent. The RIL stock was among the top weekly gainers in the Nifty basket.

Disclaimer: Network18, the parent company of CNBCTV18.com, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

First Published: Oct 21, 2022 8:24 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

AAP protest today: Delhi traffic police issues traffic advisory, security at BJP headquarters beefed up

May 19, 2024 11:26 AM

BJP is planning to ban RSS, says Shiv Sena (UBT) chief Uddhav Thackeray

May 18, 2024 8:01 PM

Punjab Lok Sabha elections: Complete list of Congress candidates

May 18, 2024 4:08 PM

Punjab Lok Sabha elections: Check full list of AAP candidates and constituencies

May 18, 2024 12:59 PM