Looking at the weak macro environment conditions across the country, weak estimates were built in for many companies for their Q3 earnings. However, with better cost management, few of those companies managed to outperform in their specific industries.

The same was the case with multiscreen players. Street expectations were muted for PVR Ltd as well as INOX Leisure on quite a few factors like weak content and challenging macro environment impacting advertisement revenues.

PVR Ltd actually missed the estimates largely due to weak southern performance but INOX leisure delivered better than expected Q3FY20 earnings.

It is noteworthy that the base for these companies was high as Q2FY20 and Q3FY19 were exceptionally robust on strong content. In Q3FY20, the content was limited to releases like War, Bala, Good Newz, Housefull 4 and Dabangg 3.

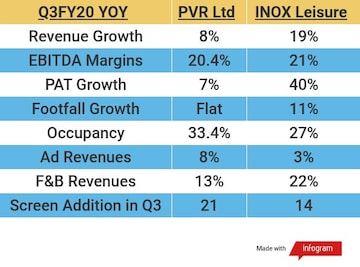

Both the companies have now started reporting earnings as per new IND AS116 with effect from April 1, 2019, which actually makes year on year number non-comparable at operating levels. Below is a snapshot of earnings is after Adjusting for IND AS116 which is taken from companies Q3 investor presentation.

The above table shows that INOX Leisure outperformed when compared to PVR Ltd in terms of revenue growth, margins, footfalls, and F&B revenues.

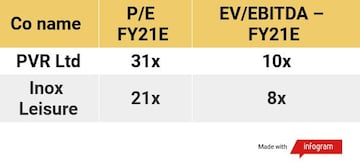

The weak ad environment impacted revenues for both the companies as ad revenue growth was in single digit. The valuation picture is also in the favour of Inox Leisure as it is currently trading at a discount when compared to PVR Ltd.

For multiplexes, content is king. Going ahead for the next three months, the line up seems strong.

Feb 2020

March 2020

April 2020

First Published: Feb 10, 2020 2:25 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Delhi Congress chief Arvinder Singh Lovely resigns

Apr 28, 2024 10:54 AM

Lok Sabha polls: Voter turnout in Rajasthan over 62%, down by 4% since 2019

Apr 28, 2024 8:49 AM