Electrical equipment manufacturer Polycab India Ltd on Thursday (January 18) reported a 15.7% year-on-year (YoY) rise in net profit at ₹416.5 crore for the third quarter that ended December 31, 2023.

In the corresponding quarter last year, Polycab India posted a net profit of ₹361 crore, the company said in a regulatory filing. A CNBC-TV18 poll had predicted a profit of ₹434 crore for the quarter under review.

The company's revenue increased 16.8% to ₹4,340 crore as against ₹3,715 crore in the corresponding period of the preceding fiscal on the back of strong volume growth in the wires & cables business. Our poll had predicted revenue of ₹4,477 crore for the quarter under review.

At the operating level, EBITDA rose 12.9% to ₹569 crore in the third quarter of this fiscal over ₹504 crore in the corresponding period in the previous fiscal. The poll had predicted an EBITDA of ₹623 crore for the quarter under review.

EBITDA margin stood at 13.1% in the reporting quarter as compared to 13.6% in the corresponding period in the previous fiscal. EBITDA is earnings before interest, tax, depreciation, and amortisation. CNBC-TV18 poll had predicted a margin of 13.9% for the quarter under review.

For the first nine months of FY24, EBITDA margin improved by 120 bps, or 1.2%,YoY to 13.9%. Improved gross margins via strategic pricing revisions as well as a change in product mix contributed to margin improvement. For Q3 of FY24, the EBITDA margin settled at 13.1%, a 130 bps, or 1.3%, decline quarter-on-quarter, largely on account of higher A&P spending, Polycab India said.

Profit After Tax (PAT) for the first nine months of FY24 witnessed a remarkable 46% year-on-year increase, standing at ₹124.94 crore, almost equivalent to the PAT of FY23. PAT margin during this period improved by 130 bps, or 1.3%, year-on-year to 10.0%.

revenue for the first nine months of FY24 and Q3 of FY24 grew by 29% and 18%, YoY, respectively, on the back of strong volume growth. Demand momentum continued to be strong supported by government and private capex.

Revenue from international business contributed 6.2% of the consolidated revenue for the quarter. The company expects a strong performance in the international business in the fourth quarter of FY24 and beyond. The sequential decline in margins of 70 bps, or 0.7%, in Q3 of FY24 was on account of lower sales contribution from international business and higher A&P spending, the company said.

The FMEG business exhibited a contraction of 15% YoY in the reporting quarter, primarily attributed to sustained weakness in consumer demand, the company said.

Other Segment: The total income for the first nine months of FY24, at ₹496.7 crore, grew by 93% YoY. Quarterly revenue was up by 118% YoY and 35% QoQ. The segmental EBIT in the first three quarters of FY24 and the reporting quarter grew by 88% and 189%, YoY, respectively. EBIT margin for the first three quarters stood at 14.3%.

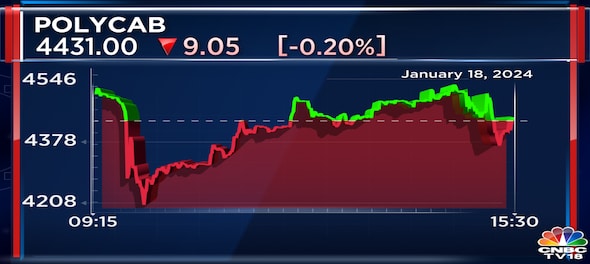

Shares of Polycab India Ltd ended at ₹4,431.00, down by ₹9.05, or 0.20%, on the BSE.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Haryana Lok Sabha elections 2024: A look at JJP candidates

May 6, 2024 2:26 PM

Yadav family members in focus in third phase of Lok Sabha polls in Uttar Pradesh

May 6, 2024 12:59 PM

Haryana Lok Sabha elections 2024: Seats, schedule, Congress-led INDIA bloc candidates and more

May 6, 2024 12:09 PM

Andhra Pradesh: Kuppam loyalty test for TDP chief Chandrababu Naidu

May 6, 2024 9:35 AM