The earnings numbers for the fourth quarter of the financial year gone by (FY23) for the oil and gas sector will be declared this week starting with Reliance on Friday. Sector watchers expect the quarter to be better than the previus one (Q3FY23) riding on realisations.

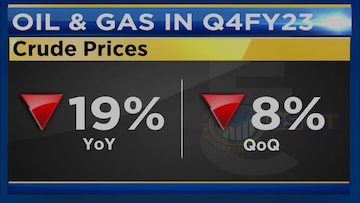

Crude prices have declined sharply to trade just a tad above $80 per barrel.

On the other hand, Singapore's gross refining margins (GRMs) have increased to levels of $8.2 per barrel versus $6.3 per barrel earlier, and this is something that will show in

Reliance Industries Ltd’s (RIL) earnings, which will see an improvement led by the O2C or the oil to chemical segment and lower windfall tax as well.

Overall, this would lead to an EBITDA increase of 5 percent on a sequential basis and on a consolidated basis as well for the company.

For oil marketing companies (OMCs), lower crude and higher refining margins will be positive, but a bigger turnaround will come in from the marketing segment, and that is where improvement will be seen.

When both segments will lead to a 77 percent sequential surge in EBITDA and 3.3 times increase in profit after tax (PAT) according to ICICI Securities.

For upstream companies, even though crude prices have declined, realisations post taxes have been around $72-76 per barrel and gas realizations have been stable quarter on quarter (QoQ). So this will see a set of.

Overall high other income will aid earnings for oil producers this time around.

City gas distribution (CGD) companies will see a mixed bag whereas Mahanagar Gas Ltd (MG) will see the best performance. MGL took sharper price hikes versus Indraprastha Gas Ltd (IGL) and hence the EBITDA performance is expected to be better.

Gujarat Gas will see a weak performance this time round led by lower demand in the industrial segment.

Nirmal Bang estimates that Gujarat Gas will see 26 percent decline in EBITDA YoY, IGL will see a 12.5 percent increase, but the biggest rise will be 72 percent increase in MGL’s EBITDA.

Now for gas utilities, GAIL and GSPL will see a weak quarter due to supply shortages and also weak demand while Petronet LNG will see better numbers. That is because of the lower spot LNG price.

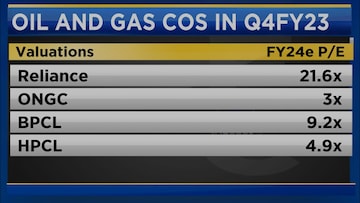

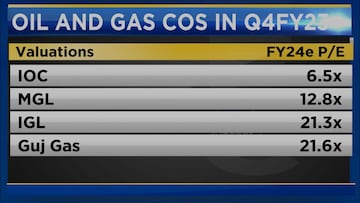

In terms of valuations, oil producers are still seeing compressed valuations. So around three times is the number for Oil and Natural Gas Corporation (ONGC), Reliance Industries is at 21.6 times.

Bharat Petroleum Corporation Ltd (BPCL) still continues to trade at a premium, MGL, which is expected to do well, is the cheapest in the city gas distribution space at around 12.8 times and the others are higher here.

For more details, watch the accompanying video

Disclosure: Network18, the parent company of CNBCTV18.com, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.