Beauty and fashion firm FSN E-Commerce Ventures, which operates the Nykaa brand, on Tuesday (February 6) reported a 97.6% year-on-year (YoY) jump in net profit at ₹16.2 crore for the third quarter that ended December 31, 2023, on strong gross merchandise value.

In the corresponding quarter last year, FSN E-Commerce Ventures had posted a net profit of ₹8.2 crore, the company said in a regulatory filing. The company's revenue from operations increased 22.3% to ₹1,788.8 crore against ₹1,462.9 crore in the corresponding period of the preceding fiscal.

At the operating level, EBITDA rose 26.4% to ₹98.7 crore in the third quarter of this fiscal over ₹78.1 crore in the corresponding period in the previous fiscal. The EBITDA margin stood at 5.5% in the reporting quarter against 5.3% in the corresponding period in the previous fiscal. EBITDA is earnings before interest, tax, depreciation, and amortisation.

The company recorded strong growth in consolidated gross merchandise value (GMV) at 29% year on year (YoY) to ₹3,619.4 crore in Q3 of FY24. The gross margin grew 20% YoY to ₹760.7 crore in the quarter and the gross margin stood at 42.5%.

Adjusted for ESOP and new business expenses (multi-brand retail operations in GCC, Nysaa) and EBITDA margin was 6.1% for Q3 of FY24. The profit before tax grew 109% YoY to ₹26.5 crore in Q3 of FY24. The profit before tax margin was 1% in Q3 of FY24 against 0.6% in Q3 of FY23.

The consolidated beauty & personal care (BPC) GMV witnessed an industry-leading growth of 25% YoY. Net sales value (NSV) growth stood at 20% YoY primarily due to higher discounting by brands in the mass and masstige segments.

The company’s physical retail footprint continues to expand, with 39 new stores launched over the last four quarters, totalling 174 stores as of December 31, 2023. The retail business now contributes to over 9% of the overall BPC GMV while also continuing to improve profitability. This is reflected in EBITDA improvement of 35% YoY.

Its retail stores are critical to the omnichannel strategy of premium brands. Over 85 premium brands are present across our store network and contribute over 2/3rd to our offline GMV, the company said.

The Nykaa-owned brands in beauty experienced a strong GMV and NSV growth of 40% YoY and 36% YoY, respectively with three brands witnessing significant scale. Dot & Key – our new age D2C skincare brand is now at a ₹500-crore GMV run rate, scaling 8x since its acquisition, it said.

Nykaa Cosmetics continues to receive much customer love and has achieved a ₹400-crore GMV run rate. Kay Beauty, India’s largest celebrity beauty brand, has witnessed rapid growth and acceptance, achieving over ₹200-crore GMV run rate, within four years of its launch.

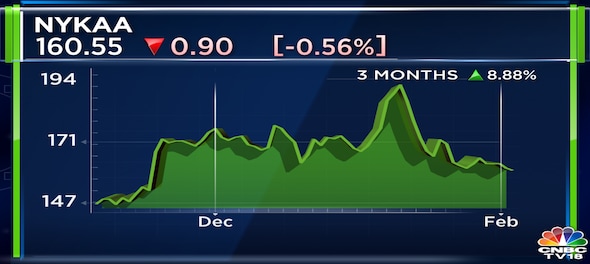

The results came after the close of the market hours. Shares of FSN E-Commerce Ventures Ltd ended at ₹160.50, down by ₹0.90, or 0.56%, on the BSE.