Gurugram-based NIIT that specialises in skills and talent development is seeing green shoots of recovery in hiring trends in the information technology (IT) sector.

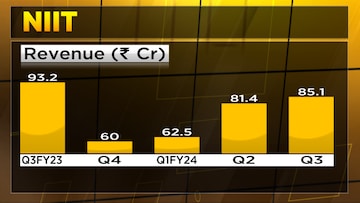

While NIIT's tech revenue declined in the third quarter due to a freeze in early-career hiring within IT firms, Vijay K Thadani, VC and MD of the company said the it has been compensated by the hiring in the banking, financial services, and insurance (BFSI) sector. Revenue from BFSI (which now contributes nearly 30% to revenues) and other programs has increased by 34% year-on-year. Overall revenue declined 9% to ₹85.1 crore from ₹93.2 crore last year. Profit after tax (PAT) was flat at ₹14.3 crore.

The company is now working to de-risk the mix and take advantage of growth sectors.

According to Thadani, there are three areas with significant opportunities. Cybersecurity and cyber risks is one such area. There are also newer areas such as artificial intelligence (AI), where it will be interesting to see how grooming of fresh talent pans out. Another interesting area that has a lot opportunity is decarbonisation, an industry that focuses on reducing carbon dioxide emissions through innovative technologies and strategies, aiming to mitigate climate change impacts and transition towards a low-carbon economy.

Also Read

The company has intensified its focus on Global Capability Centers (GCCs) and Tier II GSIs, while also witnessing the scaling up of its BFSI and India Enterprise Business due to increased demand.

With a net cash balance of ₹718 crore, the company is emerging from the negative growth cycle that began in Q4FY23 and is improving its profitability, he noted.

The stock has shed around 62% over last year. The company's current market capitalisation is ₹1,797.59 crore.

For more details, watch the accompanying video

(Edited by : Shweta Mungre)