Indian technology services stocks like TCS, HCLTech, Wipro, Infosys and other constituents of the Nifty IT index are trading with losses on Tuesday after their global peer EPAM cut its guidance for the second quarter of 2023, as well as the full year. In fact, the top five losers on the Nifty 50 index are the five technology names.

The Nifty IT index is also down 2.5 percent on Tuesday, which is its worst day since April 17 this year. All constituents of the Nifty IT index are trading with losses.

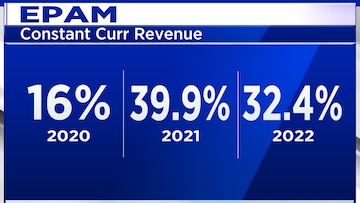

EPAM reported results on May 5, post which it released a mid-quarter update last night and has further cut its guidance by nearly 5 percent. The street has not taken the guidance cut well as EPAM was known to be a very fast growing company. Growth in the last two calendar years has been in excess of 30 percent.

However, EPAM is now expecting revenue to decline by 0.5-3.5 percent in 2023. This is the second time it has cut its guidance in as many months. The new figure is also a stark contrast to the 9 percent-plus growth it had guided for in February this year. It revised that figure to 2.5-3.5 percent in May, before coming out with the latest cut.

EPAM mentioned that since its earnings call in May, clients have become even more cautious when it comes to spending, specifically in the "build" segment of the IT services market.

After careful assessment of changes in our May and June forecast data, we have come to understand that pipeline conversions are occurring at slower rates than previously assumed and we are also seeing some reduction in the total pipeline.

Analysts believe that companies with higher discretionary spending in the portfolio are at a greater risk, as EPAM has a large exposure to discretionary spending.

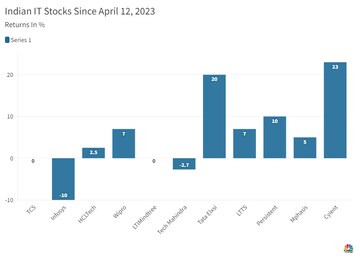

A note from Kotak Institutional Equities expects revenues for Indian IT in the June quarter to be weaker compared to March. "We believe that the demand environment is especially weak in the financial services and technology segments," the note said. The brokerage further said that it is surprised by the rally in stock prices across its coverage in the past month, given the weak demand.

Here's how Indian IT stocks have fared since April 12:

Apurva Prasad of HDFC Securities said that EPAM has been reducing guidance over the last few quarters and part of their guidance cut is also due to company specific issues. Despite the cut in guidance, he expects mid-tier IT companies to do double-digit growth. He also mentioned that the divergence between the tier-I IT companies and the others is increasing and that valuations in some pockets look stretched.

(Edited by : Hormaz Fatakia)

First Published: Jun 6, 2023 12:04 PM IST