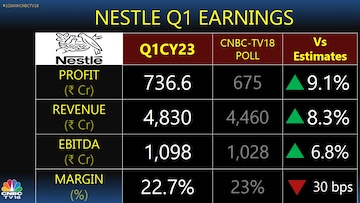

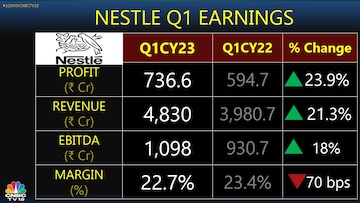

Nestle delivers strong set of numbers for Q1 CY2023 with revenues at over Rs 4,800 cr versus the CNBC-TV18 poll of Rs 4,460 cr. This is a jump of 21 percent over the same quarter of last year. This is the first FMCG player to report results for the March 2023 ended quarter- which starts on a promising note.

Gross margins have lowered sequentially as well as year-on-year basis to 53.8 percent in first quarter of CY2023 owing to milk inflation, compared with 55.4 percent in first quarter of CY2022 and 54.9 percent in last quarter of CY2022. Amnish Aggarwal, Prabhudas Lilladher says "one should not expect gross margins to improve henceforth".

Earnings before interest, tax, depreciation and ammortisation is higher at Rs 1,098 cr versus the CNBC-TV18 poll of Rs 1,028 cr. The margin though are lower than street expectation at 22.7 percent compared with 23.4 percent clocked in same quarter of last year.

While delivering robust sales, the company says this is the highest growth in a quarter in the last decade, excluding the exceptional quarter in 2016 which was off a low base in 2015. The company's volume growth is at 5 percent compared with expectation of 3 to 4 percent. However, the company's volume growth ex-Maggi small packs is higher at 11-12 percent.

The company says "All our product groups delivered double-digit growth." This depicts the company's strong execution given a slowdown in rural India. Commenting on various product group performances, the company says "Confectionery led by KITKAT, and MUNCH posted a strong growth, supported by consumer led campaigns, innovation and engagement. Beverages turned in another quarter of robust growth and market share gains led by NESCAFÉ Classic, NESCAFÉ Sunrise, and NESCAFÉ GOLD. Prepared Dishes and Cooking Aids delivered strong growth across all products in its portfolio. Milk products and Nutrition continued its strong performance led by MILKMAID among others."

The company further adds that its Out-of-Home business continued to accelerate rapidly this quarter. It focused on expansion in relevant geographies, channel prioritization and opening of new kiosks in key

locations.

On commodity inflation, the company is witnessing early signs of softening for edible oils, wheat and packaging materials. However, cost of fresh milk, fuels, and green coffee are expected to remain firm because of continued increase in demand and volatility.

The company has declared an interim dividend for 2023 of Rs 27 per equity share amounting to Rs 2,60 crore, which will be paid on and from 8th May 2023 along with the final dividend for 2022 of Rs 75 per equity share approved in the Annual General Meeting on 12th April, 2023.

The stock is trading about 1 percent lower on exchanges at around Rs 20,530 and 2 percent away from its 52-week highs. The stock is up 5 percent in 2023 till date and up 13 percent in past one year.

Amnish Aggarwal, Prabhudas Lilladher says valuations for the stock have been expensive and expects moderate returns from hereon. Naveen Kulkarni, Axis Securities says if investors are looking at having an exposure to FMCG sector, Nestle India is a good pick given its good product profile with consistent growth rate and expects the stock to continue to grow ahead of the market.

First Published: Apr 25, 2023 11:05 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Rapido offers free rides to voters to polling stations on May 13 in Hyderabad, 3 other cities

May 6, 2024 5:49 PM

Lok Sabha elections 2024: Seats to date, all you need to know about third phase of voting

May 6, 2024 4:49 PM

Concerns on low voter turnout a "myth"; absolute number of voters correct way to analyse: Report

May 6, 2024 2:57 PM

Haryana Lok Sabha elections 2024: A look at JJP candidates

May 6, 2024 2:26 PM