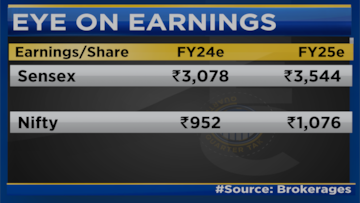

Gautam Duggad, Head of Research for Institutional Equities at Motilal Oswal Financial Services expects corporate earnings growth of 22% in FY24.

Duggad shared his expectations on the second quarter earnings across sectors in an interview with CNBC-TV18. Tata Consultancy Services kicks off the Q2 earnings season on Wednesday.

High growth expected in mid and small caps in Q2

Beyond large-cap companies, Duggad believes that the second quarter will witness significant growth in both mid-cap and small-cap segments.

Strong commodity sales growth across sectors

Duggad expects robust sales growth in commodities across different sectors. This trend reflects the resilience of the commodities market and its potential to contribute significantly to India's economic growth.

Expectations for healthcare and IT margin expansion

In terms of sectors, Duggad predicts positive margin expansion for healthcare and

information technology (IT). This anticipated growth in profitability showcases the potential for these sectors to outperform and generate healthy returns for investors.

Surprising performance expected in the auto sector

Duggad shared his perspective on the

auto sector, suggesting that it could deliver a surprise performance in the second quarter of FY24. This optimism is based on the potential for both volume and margin expansion in the industry.

Favourable conditions for the financial sector

Duggad anticipates substantial growth in the financial sector, with expectations of 25-27% expansion. He also emphasized the attractiveness of banking stocks from a valuation perspective, indicating favourable investment opportunities in this segment.

In the financial space, Duggad expressed a preference for Public Sector Undertaking (PSU) banks and Non-Banking Financial Companies (NBFCs). This preference underscores his positive outlook for these sectors and suggests that they may offer compelling investment options.

For more details, watch the accompanying video