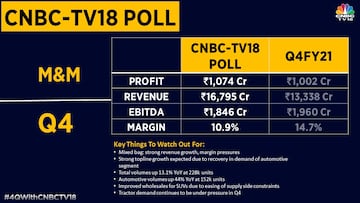

Auto major Mahindra & Mahindra (M&M) will likely report a 34 percent year-on-year increase in net profit to Rs 1,074 crore for the January-March period, according to analysts polled by CNBC-TV18. They expect the company to clock strong growth in revenue but its margin will likely be under pressure, rendering the earnings a mixed bag.

M&M is scheduled to post its quarterly results on Saturday, May 28.

The company had reported an adjusted profit of Rs 1,002 crore for the corresponding period a year ago, on account of an extraordinary loss of Rs 839 crore.

Analysts polled by CNBC-TV18 estimate M&M's revenue growth at 26 percent on year to Rs 16,795 crore for the quarter ended March 2022, on the back of a recovery in demand for its automotive segment.

They peg the company's earnings before interest, taxes, depreciation and ammortisation (EBITDA) at Rs 1,846 crore, down six percent on a year-on-year basis.

The analysts see M&M's operating profit margin reducing by 380 basis points to 10.9 percent for the March quarter thanks to an inferior segmental mix, a decline in the high margin tractor business and raw material cost pressure.

According to the CNBC-TV18 poll, Mahindra & Mahindra's total volume is estimated to increase 13.1 percent to 2,28,000 units compared with the corresponding period a year ago.

That will be driven by a 44 percent on year jump in automotive volumes to 1,52,000 units, though tractor volumes are expected to take a dent of 22 percent to 72,882 units, according to the analysts.

They see easing in supply-side constraints to lead to improved SUV wholesales for the company.

The analysts estimate the auto maker's net realisation to increase 12.9 percent to Rs 7.44 lakh per unit in the January-March period.