Indian automotive giant Mahindra & Mahindra (M&M) is gearing up to unveil its financial performance for the third quarter of fiscal year 2023-24 on February 14, 2024.

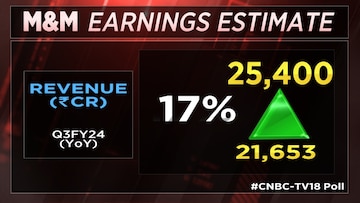

According to a CNBC-TV18 poll, the anticipated Q3 revenue for

Mahindra & Mahindra stands at

₹25,400 crore, reflecting a 17% growth compared to the same quarter last year, where the company reported

₹21,653 crore.

The

earnings before interest, taxes, depreciation, and amortization (EBITDA) are projected to rise by 14% to

₹3,225 crore against

₹2,814 crore reported in Q3 of FY23.

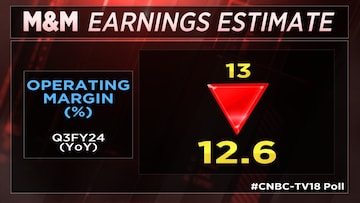

However, the street expects a marginal dip in the margin, from 13% in Q3 of FY23 to 12.6% in the current quarter. Meanwhile, the profit after tax (PAT) is predicted to surge by 54% to ₹2,353 crore.

One of the key drivers of Mahindra & Mahindra's growth is anticipated to be the 11.1% year-on-year increase in overall volumes, reaching 3,13,000 units compared to 2,81,000 units in tmhe corresponding quarter last year.

This strong performance is primarily attributed to the robust growth in the

automotive sector. However, challenges persist in the tractors business due to the high base established last year and the impact of uneven

rainfall.

The company's stock traded on Tuesday with a minor decline of 0.6% at ₹1,650 per share. The Mumbai headquartered company boasts a market capitalisation of ₹2,04,778 crore. Over the last six months, the company has delivered a 6% return to its shareholders.