Credit card and bill payment fintech unicorn CRED saw its total income grow by 3.5 times in the financial year ending March 2023 with its monthly transacting users growing by over 58 percent, the company said in a statement.

“Five years since launch, we believe that CRED — and prudent financial behavior — are becoming a habit for the top 1%. Our focus remains on rewarding the creditworthy with more products that improve their lives and lifestyles,” said

Kunal Shah, Founder, CRED.

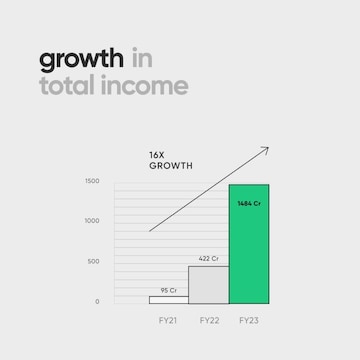

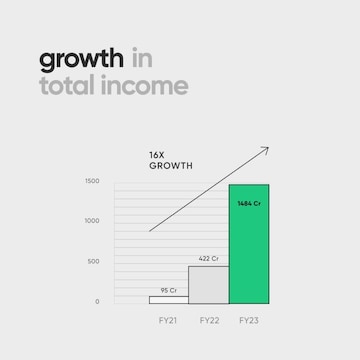

CRED's total income for FY23 grew to Rs 1,484 crore compared to Rs 422 crore the year before and Rs 95 crores in FY21. "Growth across revenue, scale, and engagement metrics as the breadth of products created platform advantages," the company said. CRED, however, continued to report losses, albeit lower compared to the previous year.

Credit card and bill payment fintech unicorn CRED's total income for FY23 grew to Rs 1,484 crore compared to Rs 422 crore the year before and Rs 95 crore in FY21.

CRED said its loss (excluding ESOP cost) reduced by 10 percent from Rs 1,167 crore in FY22 to Rs 1,047 crore in FY23. The company said it is seeing growth in engagement, breadth of products and member scale, which has resulted in reduced cost of acquiring and serving members. It said its customer acquisition cost reduced by almost 80 percent compared to when it started its journey 5 years ago, and its marketing and business promotion spends came down 27 percent to Rs 713 crore in FY23 from Rs 975 crore in FY22.

"We strengthened the platform with more touchpoints for members to engage with CRED at a higher frequency in FY22-23. This resulted in significantly higher engagement that created monetisation opportunities while reducing the cost of attracting and serving members," said CRED.

In the Unified Payments Interface (UPI)-based payments, CRED said that it is now the fourth largest (by value)

UPI app in India.

The startup claims that a third of all credit card bill payments (by value) are done on the CRED platform now. It also saw a 77 percent increase in TPV (total payment value) to Rs 4.4 lakh crore in FY23 from Rs 2.5 lakh crore in FY22. "Members spent more time on CRED, resulting in higher attention and use of multiple products. Today, 90% of CRED members redeem at least one reward every month," it said.

An average CRED monthly transacting user (MTU) now does more than 20 sessions a month, it claimed, adding that more than half of its transacting members use two or more CRED products every month.

The company's

ESOP costs grew to Rs 300 crore in the year, as the company increased its talent density, it said. "Increasing talent density remains a priority, leading to an increase in employee benefit expenses."

(Edited by : Ajay Vaishnav)

First Published: Oct 5, 2023 2:56 PM IST

Credit card and bill payment fintech unicorn CRED's total income for FY23 grew to Rs 1,484 crore compared to Rs 422 crore the year before and Rs 95 crore in FY21.

Credit card and bill payment fintech unicorn CRED's total income for FY23 grew to Rs 1,484 crore compared to Rs 422 crore the year before and Rs 95 crore in FY21.