The Sajjan Jindal-led JSW Steel on Friday, October 21, reported a net loss of Rs 915 crore for the second quarter that ended September 30, 2022, impacted by a sharp fall in steel prices.

In the corresponding quarter last year, the company posted a net profit of Rs 7,179 crore. CNBC-TV18 Polls had predicted a net profit of Rs 490 crore for the quarter under review.

The company's income stood at Rs 41,778 crore during the period under review, up 28.5 percent against Rs 32,503 crore in the corresponding period of the preceding fiscal.

At the operating level, EBITDA declined 83.2 percent to Rs 1,752 crore in the first quarter of this fiscal compared to Rs 10,417 crore in the corresponding period in the previous fiscal.

The EBITDA margin stood at 4.2 percent in the reporting quarter against 32 percent in the corresponding period in the previous fiscal. EBITDA is earnings before interest, tax, depreciation and amortisation.

Also read: Tata Consumer profit beats estimates, revenue jumps 11% to Rs 3,363 crore despite price cuts

The company's performance during the quarter was significantly impacted by a sharp fall in steel prices. "Despite a challenging global economic scenario, we expect healthy steel demand growth in India during H2 FY23, which along with the flow through lower raw material prices, should aid the company's performance in the coming quarters," JSW Steel said in a regulatory filing.

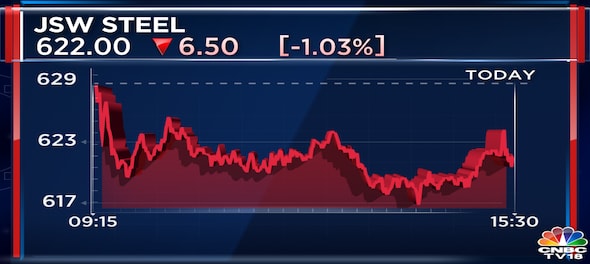

The results came after the close of the market hours. Shares of JSW Steel Ltd ended at Rs 622, down by Rs 6.50, or 1.03 percent on the BSE.

(This is a developing story. Check back for more details)

(Edited by : Shoma Bhattacharjee)

First Published: Oct 21, 2022 5:06 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP replaces Poonam Mahajan with lawyer Ujjwal Nikam for Mumbai North Central Lok Sabha seat

Apr 27, 2024 7:53 PM

Meet Amritpal Singh, the separatist leader contesting Lok Sabha polls from Punjab's Khadoor Sahib

Apr 27, 2024 7:18 PM