Sajjan Jindal-led JSW Steel Ltd reported on Thursday (January 25) a 409.28% year-on-year (YoY) jump in consolidated net profit at ₹2,415 crore for the third quarter that ended December 31, 2023. In the corresponding quarter last year, JSW Steel posted a net profit of ₹474 crore, the company said in a regulatory filing. A CNBC-TV18 poll estimated a profit of ₹1,745 crore for the quarter under review.

JSW Steel's consolidated revenue from operations increased 7.2% to ₹41,940 crore as against ₹39,134 crore in the corresponding period of the preceding fiscal. The CNBC-TV18 poll estimated a revenue of ₹42,225 crore for the quarter.

At the operating level, EBITDA jumped 57.9% to ₹7,180 crore in the third quarter of this fiscal over ₹4,547 crore in the corresponding period in the previous fiscal. The CNBC-TV18 poll estimated an EBITDA of ₹6,484 crore for the quarter.

#3QWithCNBCTV18 | JSW Steel reports Q3 earnings

-Net Profit at ₹2,415 cr vs ₹474 cr (YoY)Here's more👇 pic.twitter.com/0DuzYfNmjB— CNBC-TV18 (@CNBCTV18Live) January 25, 2024

EBITDA margin stood at 17.1% in the reporting quarter as compared to 11.6% in the corresponding period in the previous fiscal. EBITDA is earnings before interest, tax, depreciation, and amortisation. The CNBC-TV18 poll estimated a margin of 15.4% for the quarter under review.

The consolidated crude steel production for the quarter stood at 6.87 million tonne, higher by 8% quarter-on-quarter and higher by 12% year-on-year. The strong performance was driven by capacity utilisation rising to 94% during the quarter against 89% in Q2 of FY24 at the Indian operations.

Capacity utilisation for 9M of FY24 was 91%. The company had taken certain maintenance shutdowns at Indian operations during Q2 of FY24. Capacity utilisation also improved at the Ohio, USA operations due to a better demand scenario.

Steel sales for the quarter stood at 6.00 million tonne, lower by 5% quarter-on-quarter and higher by 7% year-on-year. Domestic sales at 5.27 million tonne were down by 4% quarter-on-quarter and higher by 2% year-on-year.

While volumes declined CloQ, the OEM & Industrial volumes were strong, up 8% quarter-on-quarter and 12% year-on-year, with the highest quarterly sales to OEM & Industrial customers, and automotive, renewable, and packaging segments, JSW Steel said.

Retail sales were particularly impacted during the quarter by higher imports and channel destocking. Exports at 0.55 million tonne fell 20% quarter-on-quarter on subdued global markets and constituted 9% of sales from the Indian operations.

The company's net gearing (Net Debt to Equity) stood at 1.02x at the end of the quarter (as against 0.92x at the end of Q2 FY24), and net debt to EBITDA stood at 2.64x (as against 2.52x at the end of Q2 FY24). The net debt increased to ₹879,221 crore during the quarter, primarily due to additional investments in working capital.

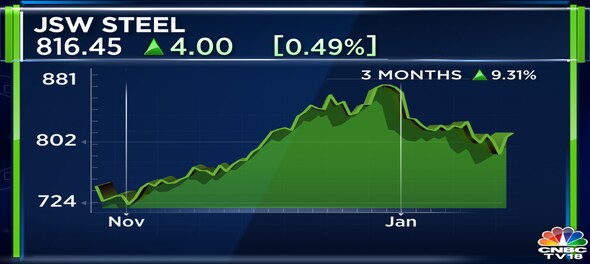

Shares of JSW Steel ended at ₹816.45, up by ₹4.00, or 0.49% on the BSE.

(Edited by : Ajay Vaishnav)

First Published: Jan 25, 2024 3:53 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna Sexual Assault Case: Activist raises concerns over political interference, delayed investigation in the matter

Apr 30, 2024 10:17 PM

Lok Sabha Election 2024: Baramati election outcome will decide the future of Pawar dynasty, says expert

Apr 30, 2024 10:08 PM

Lok Sabha elections 2024: Baramati to Mainpuri, key battles in phase 3

Apr 30, 2024 7:01 PM