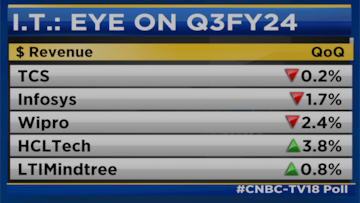

The Indian information technology (IT) sector is all set to report the earnings for the third quarter of the financial year 2024. Tata Consultancy Services (TCS) and Infosys will be kickstarting the October-December quarterly earnings season on January 11.

Infosys Ltd., TCS Ltd.,

Wipro Ltd., and

Tech Mahindra Ltd., four out of India's top six technology services companies, that are also part of the Nifty 50 index, may see US Dollar revenue decline during the December quarter, according to a

CNBC-TV18 poll.

Experts are uncertain about the outlook given the uptick in furloughs, and subdued demand for discretionary services, in a seasonally weak quarter.

While the December quarter is generally seen as a weak one due to the holiday season, the seasonality this time looks higher than usual.

Wipro is projected to experience the sharpest dollar revenue decline at -2.4%, while Infosys could report a 1.5-2% dip, and TCS is expected to remain relatively flat.

In its expectations report, Kotak Institutional Equities predicted a muted performance across the IT sector in the third quarter, with market focus shifting towards the prospect of revenue acceleration in the fiscal year 2025.

Also Read

In an interview with CNBC-TV18, Kawaljeet Saluja, ED & Head-Research at

Kotak Institutional Equities said, "The key thing which everyone will be focused on is revenue acceleration in FY25, and whether there are any signs of visibility of that acceleration."

Saluja anticipates improved revenue growth in FY25, driven by mega deals ramping up, contributing a potential 2-4% to the overall growth of the IT industry in the fiscal year 2025.

For more details, watch the accompanying video

(Edited by : Shweta Mungre)

First Published: Jan 9, 2024 4:01 PM IST