If there ever was a quarter where laying out expectations for IT companies could be the trickiest, it is this one. Indian IT companies will kickstart the March quarter earnings season this week, with TCS reporting results on April 12.

Considering the fact that we are in a period of heightened uncertainty, there is a broad divergence in expectations for IT companies this quarter.

Lets take TCS for example - the range of constant currency growth expectations varies from 0.1 percent to 1.7 percent. For Infosys, it is a negative 0.1 percent to positive 1.1 percent, while for HCLTech, CLSA expects a decline of 2.9 percent, while Nomura expects a 1.1 percent growth.

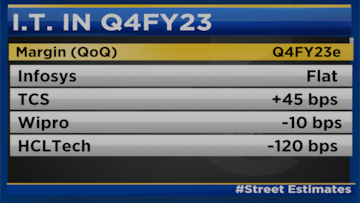

EBIT margin is likly to see more divergence among largecap IT names. Margin for TCS may expand, while that of HCLTech is expected to decline sequentially.

The key this quarter will be what will the companies guide for the new financial year. Infosys is likely to guide for 6-8 percent growth in financial year 2024, much lower than the 16 percent growth it saw last year. But Infosys, true to script, will remain conservative in its guidance.

Apurva Prasad of HDFC Securities said that he is expecting 5-8 percent revenue guidance from Infosys for financial year 2024 due to the prevailing uncertainty. Prasad also said that he has moderated growth estimates for the March quarter as well as the June quarter.

For HCLTech as well, it is difficult to get a consensus on guidance but analysts are expecting the company to guide for a mid-single-digit growth for the year.

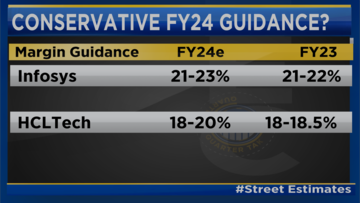

However, both Infosys and HCLTech are likly to raise the upper-end of the margin guidance. Infosys may raise its margin guidance to 21-23 percent from 21-22 percent earlier, while HCLTech may raise its band to 18-20 percent from 18-18.5 percent earlier.

Secondly, retail, hi-tech and Europe were flagged off as the weak points in the previous quarters. Does the weakness continue there is something that will have to be monitored.

Three, will normalcy return in the second half of this financial year? Analysts are hoping for the same. Specific to companies, TCS will be eligible to announce a buyback, leadership changes at TCS and Tech Mahindra will also take place. So any changes in strategic direction will be looked at. New appointments for TCS will also be in focus as it will have to appoint a new BFSI head, while its COO retires next year.

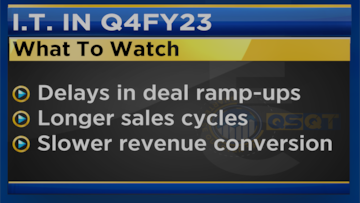

Lastly, we are witnessing delays in deal ramp-ups, sales cycle is getting elongated and revenue conversion is slower. The question is, does the recent correction in stock price factor in the moderating growth as valuations are close to their five-year average.

HDFC Securities' Prasad further said that he expects TCS to report the highest constant currency growth among the tier-1 companies with 1 percent growth, saying that commentary around leadership changes at TCS will be keenly watched.

He advises investors to be selective when it comes to Indian IT companies.

The Nifty IT index is up close to a percent for the year so far.

(Edited by : Hormaz Fatakia)

First Published: Apr 10, 2023 11:15 AM IST