Technology services providers TCS Ltd.,

Infosys Ltd.,

Wipro Ltd. and others will be in focus for the rest of the month as they begin reporting their September quarter results, starting with TCS on October 11.

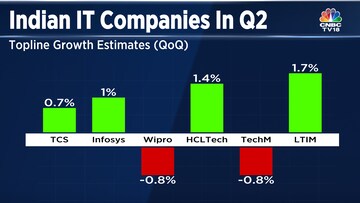

The Nifty IT index has risen 7.5% in the July-September quarter, comfortably outperforming the Nifty 50 index, which rose only 1.6%. The outperformance has been driven by strong deal wins and expectations of demand revival in financial year 2025, as most analysts on the street have been projecting.

This time around, the focus will be on signs; commentary on whether the worst of the demand deterioration is over, whether there are greenshoots in demand, will growth recover in the second half of financial year 2024 and what is financial year 2025 looking like?

The September quarter appears to be a continuation of the weakness seen earlier. While there have been strong deal wins, there has been no deterioration in demand but no improvement either.

Infosys is likely to see another quarter of just 1% growth, while Wipro's revenue may decline for the third straight quarter. However, that number is likely to be within its guided range.

The highlight of the quarter will be the deal wins. Large deals have been particularly robust during the quarter. Infosys, for example, signed a large deal with Liberty Global, TCS with Jaguar Land Rover, HCLTech with Verizon etc.

Kotak Institutional Equities estimates Infosys to report Total Contract Value between $5.5 billion to $6 billion, well above the previous eight-quarter average of $2.4 billion. TCS may report deal value worth $12 billion, up 48 percent from last year.

The question to be asked though, is whether these large deals will be margin dilutive? For the September quarter, margins are likely to remain stable.

Some of the other factors to watch out for for specific companies:

Infosys: Likely to maintain its financial year 2024 revenue growth guidance of 1%-3.5% and EBIT margin guidance of 20%-22%.

HCLTech: Revenue guidance of 6%-8% is likely to be maintained but the company could guide for margins to be at the lower end of the guidance of 18%-19%.

Tech Mahindra: Focus would be on strategy under the new CEO and margin recovery.On the valuation front, most of the companies on a financial year 2025 basis are trading below their three year average, but trading well above their pre-Covid three-year average.

| Company | Valuation (FY25 P/E) | Three-Year Average P/E | Pre-Covid Three-Year Average P/E |

| Infosys | 20x | 23x | 18x |

| TCS | 24x | 27x | 22x |

| Wipro | 17x | 20x | 15x |

| HCLTech | 19x | 20x | 14x |

| LTIMindtree | 26x | 30x | 17x |

| Tech Mahindra | 21x | 20x | 15x |

For more details, watch accompanying video

(Edited by : Hormaz Fatakia)

First Published: Oct 8, 2023 8:07 PM IST