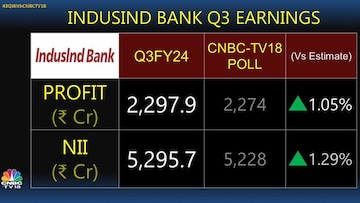

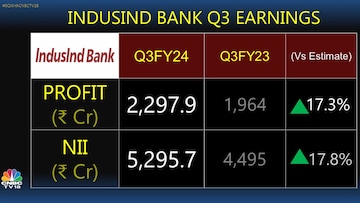

IndusInd Bank on Thursday, January 18, reported around 17.3% rise in net profit to reach ₹2,297.9 crore for the October–December quarter, compared to ₹1,959.2 crore in the same period last year. CNBC-TV18 poll had anticipated a net profit of ₹2,274 crore.

The lender had posted NII at ₹4,495 crore in the corresponding period of the previous year.

The Gross Non-Performing Assets (NPA) stood at 1.92%, a marginal improvement from the previous quarter's 1.93%. Similarly, the Net NPA remained stable at 0.57%.

As per Basel III norms, the lender recorded a capital adequacy ratio of 17.86%, showing a slight decline from 18.21% in the previous quarter and 18.01% in the same quarter of the previous year.

The Common Equity Tier 1 (CET 1) ratio for the reporting period was 16.07%. Maintaining consistency, the Provision Coverage Ratio remained at 71% as of December 2023.

The Net Interest Margin (NIM) for the third quarter held steady at 4.29%, unchanged from the preceding September quarter.

On Thursday,

IndusInd Bank's shares witnessed 1.7% decline, closing at ₹1,615.75 on the NSE.

First Published: Jan 18, 2024 4:23 PM IST