Following a better fiscal year 2023 with an EBITDA of at least Rs 6.91 per standard cubic meter (scm), Indraprastha Gas (IGL) is Looking ahead for a much stronger EBITDA in the current financial year. The company expects its EBITDA to be in the range of Rs 7.5 to 8 per scm for FY24.

Speaking to CNBC-TV18, Sanjay Kumar, Managing Director of IGL said, “Our EBITDA per SCM was Rs 6.91 for the last financial year. For this financial year we estimate it to be Rs 7.5-8 per SCM. That is the likely range that we may continue for the year 24-25 also.”

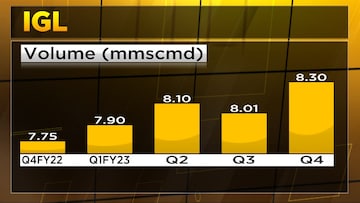

Furthermore, Kumar anticipated that IGL's volumes would reach approximately 9 million metric standard cubic meters per day (mmscmd) in FY24.

“Regarding volume, we were at 8.1 million cubic meter last financial year per day, we estimate that to be in the range of 9 million cubic meter per day for the ongoing financial year.”

Kumar attributed this expected growth to the commissioning of additional infrastructure in new areas. The development of these new areas will provide IGL with an opportunity to expand its customer base and enhance its overall operational efficiency.

Regarding profitability, Kumar predicted that IGL's profit after tax (PAT) would be around Rs 1,600 crore in FY24, primarily driven by higher volumes. This projection showcases IGL's focus on achieving sustainable growth and delivering value to its stakeholders.

Kumar said, “We estimate our path to be in the range of Rs 1,600 crore for this financial year based on the higher volume as well as the maintaining the margin. This month we are earning about Rs 7.50 per SCM EBITDA so, our PAT is likely to be in the range of Rs 1,600 crore for the FY24 that is our estimate.”

Looking ahead, Kumar mentioned that IGL continues to explore acquisition opportunities. However, he clarified that nothing has been finalized yet, highlighting the company's cautious and strategic approach to expansion.

Regarding costs, Kumar indicated that the gas cost per scm in FY24 is expected to be around 25. This projected cost is higher than the Rs 17 per scm recorded in FY22 and the Rs 35 per scm for FY23.

At 11:30 am, the stock was trading at Rs 484.50 on the NSE, lower by 1.78 percent. It has lost over 1 percent in the last one months.

(Edited by : C H Unnikrishnan)

First Published: May 16, 2023 12:38 PM IST