Indian Oil Corporation Ltd., India's largest state-run oil refiner is likely to return to profitability in the December quarter, after two consecutive quarters of losses, in which it lost over Rs 2,000 crore.

The rebound is likely to be led by the marketing segment, which will be aided by a decline in crude oil prices.

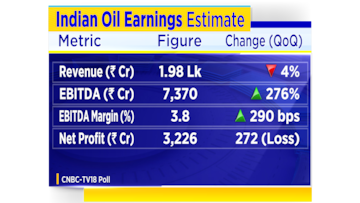

While the company may report a profit worth over Rs 3,000 crore during the quarter, its topline may decline on a sequential basis, according to a CNBC-TV18 poll.

Indian Oil used 50 percent of the one-time grant of Rs 22,000 crore given by the government to compensate the three OMCs on their LPG under recoveries.

Under recoveries is the gap between the cost and the selling price of fuel. In case the selling price is lower than the cost price, higher is the under recoveries.

It is unclear whether a similar grant would be made this time as well.

CNBC-TV18 had reported earlier this month citing sources that state-run Oil Marketing Companies (OMCs) - HPCL, BPCL and Indian Oil Corporation were seeking compensation of as much as Rs 50,000 crore to cover up for the losses that they have incurred due to the freeze in fuel prices.

As an immediate measure, companies are of the view that diesel prices can be hiked by Rs 2-3 per litre, according to sources, who also said that the OMCs are currently making some loss on diesel and marginal gains on petrol.

Refinery throughput is likely to rise 3 percent from last year and 12 percent from September to 18 million metric tonnes, led by a utilisation ramp-up at its refineries.

However, the petchem business is likely to remain subdued as the number of polyethylene (PE) and polypropylene cracks continue to decline on a sequential basis.

Reported refining margin of $15 per barrel is likely to aid Indian Oil the most among its peers. The figure in the September quarter stood at $18.5 per barrel.

On the valuation front, Indian Oil Corporation trades at 7x Earnings per Share (EPS) for financial year 2024, compared to BPCL’s 8x and HPCL's 5.5x.

Shares of Indian Oil have remained flat over the last 12 months. The stock has gained 5 percent in January.

(Edited by : Rukmani Krishna)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!