Hindalco Industries on Wednesday (May 24) posted its earnings for the January to March 2023 quarter, in which it beat CNBC-TV18 poll estimates on all fronts, including profit, revenue, EBITDA and margin. The metals manufacturing firm was also able to bring down its net debt by nearly 18 percent following working capital release at its US subsidiary Novellis.

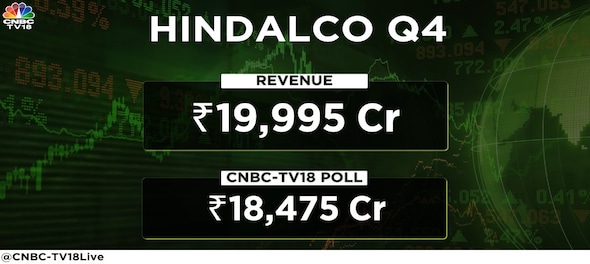

However, compared to the corresponding three-month period last fiscal, the company witnessed a huge dip, except for standalone revenue, which went up five percent to Rs 19,995 crore, as against Rs 18,475 crore, in the March quarter (Q4FY22) of previous fiscal.

Aluminium upstream revenue was down by 13 percent YoY due to lower metal prices. For the copper business, revenue rose 14 percent YoY in Q4- FY23, on account of higher global prices of copper and higher volumes.

While aluminium volumes came in at 341 kt for the last quarter versus the poll of 338 kt, copper volumes at 117 kt came in higher than the projection of 105 kt. The operating profit or EBITDA (earnings before interest, taxes, depreciation, and amortisation) for the aluminum and copper segments also beat the expectations and were recorded at Rs 2,304 crore and Rs 598 crore, respectively.

Meanwhile, Hindalco’s Q4 net debt stood at Rs 33,959 crore, down from Rs 41,716 crore in the December 31, 2022 ended quarter.

On a consolidated basis, the metals firm posted an all-time high full year revenue at Rs 2,23,202 crore.

The Aditya Birla Group metals flagship firm said that its India business is almost net debt free, which is an enabler for organic growth. The focus is now on resource security and downstream expansion, it said.

For its US subsidiary Novelis, the firm saw net sales in Q4-FY23 worth $4.4 billion, down 8 percent YoY, impacted by lower average aluminium prices and subdued sales volume YoY, it said.

Novelis’ Adjusted EBITDA or operating profit at $403 million for the quarter under review fell six percent annually, primarily due to lower shipments, inflationary environment, higher energy costs due to geopolitical instability, and less favourable metal benefits, the company said in its presentation for investors.

According to the firm, these headwinds were partially offset by higher product pricing, including some cost passthroughs to customers, and favorable product mix.

Also Read: The fear around China is melting metals and Indian metal stocks like Hindalco and Vedanta

Reflecting on the outlook, the firm said it is eyeing a shift from being a metal manufacturer to becoming a solution provider. It is committed to maintain a strong balance sheet and focus on shareholder value creation through prudent capital allocation, it said.

First Published: May 24, 2023 2:36 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Vizag as executive capital, hike in welfare pensions: Key points in YSRCP's election manifesto

Apr 27, 2024 4:03 PM

Supreme Court verdict on EVMs — why upholding the voter’s trust is important

Apr 27, 2024 2:23 PM