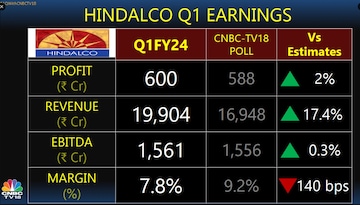

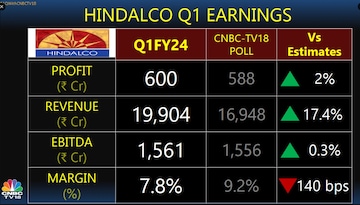

Aluminum and copper manufacturing company Hindalco on August 8 reported its financial results for the April to June 2023 period in which its profit declined nearly 60 percent on a year-on-year basis to Rs 600 crore. It, however, came in higher than the CNBC-TV18 poll projection of Rs 588 crore.

The firm's revenue for the quarter under review saw a two percent increase annually to Rs 19,904 crore, which is also 17 percent higher than what analysts polled by CNBC-TV18 had expected.

Hindalco's margin and earnings before interest, taxes, depreciation, and amortization (EBITDA) saw massive dips. While EBITDA came in 46 percent lower YoY at Rs 1,561 crore, margin slipped to 7.8 percent from 15 percent in the first quarter of the previous fiscal.

Following the June 2023 ended quarter results, Hindalco shares were trading more than two percent lower at Rs 454 on BSE.

On a segment wise basis, Hindalco reported a decline of 39 percent in its first quarter total aluminum EBITDA, while copper EBITA fell six percent.

Satish Pai, Managing Director, Hindalco Industries, said, “FY24 has started on a promising note. Our focus on expanding our value-added portfolio and operational efficiencies has enabled us to deliver a sustained performance in the face of continued macroeconomic pressures.”

He noted that an enhanced product mix saw the aluminum India downstream business generating higher value, with Q1 EBITDA increasing by 31 percent sequentially.

He added that despite significant market headwinds, Novelis continued to show sequential improvement in adjusted EBITDA and EBITDA per ton, backed by record sales of automotive aluminium sheets. The copper business, meanwhile, achieved record metal sales and maintained its market share despite undergoing a planned shutdown.

“We will continue to strongly position our Company for the future, by maintaining our focus on ESG, controlling costs, securitising resources, and driving downstream expansion,” he said.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election Phase 2: Experts decode the key trends and issues in key battleground states

Apr 26, 2024 11:53 PM

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM