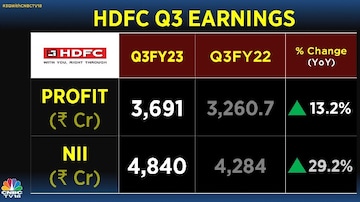

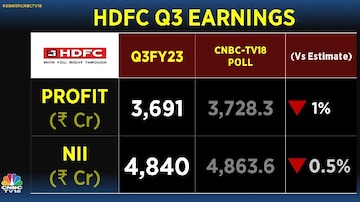

Housing Development Finance Corporation (HDFC) on Thursday reported 13.2 percent rise in net profit at Rs 3,690.9 crore for the third quarter of FY23, mostly in-line with estimates. CNBC-TV18 poll had a predicted the same at Rs 3,728.3 crore. In the same quarter of FY22, the net profit was reported at Rs 3,260.7 crore.

The net interest income (NII) came in at Rs 4,840 crore, versus Rs 4,284 in the same quarter of FY22.

Here's how the numbers compare with CNBC-TV18's poll

The profit before tax for the quarter ended December 31, 2022 stood at Rs 4,612 crore compared to Rs 4,048 crore in the corresponding quarter of the previous year. Revenue from operations rose 29 percent to Rs 15,230 crore during the quarter under review. Dividend income more than doubled to Rs 482 crore during the quarter.

As of December 31, 2022, the gross individual NPLs stood at 0.86 percent (previous year: 1.44 percent) of the individual portfolio, while the gross non-performing non-individual loans stood at 3.89 percent of the non-individual portfolio. The gross NPLs stood at Rs 8,880 crore.

Total expenses rose 37.3 percent to Rs 10,635 crore, mainly driven by higher finance costs that surged 41 percent.

Earlier, HDFC Bank agreed to take over HDFC in a deal valued at about $40 billion, creating a financial services titan. The deal has got in-principle approval from the stock exchanges, Reserve Bank of India (RBI), SEBI, Pension Fund Regulatory and Development Authority (PFRDA), and Competition Commission of India (CCI).

The proposed entity will have a combined asset base of around Rs 18 lakh crore. The merger is expected to be completed by the second or third quarter of FY24, subject to regulatory approvals. Once the deal is effective, HDFC Bank will be 100 percent owned by public shareholders, and existing shareholders of HDFC will own 41 percent of the bank. Every HDFC shareholder will get 42 shares of HDFC Bank for every 25 shares held.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election Phase 2: Experts decode the key trends and issues in key battleground states

Apr 26, 2024 11:53 PM

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM