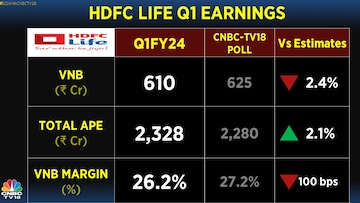

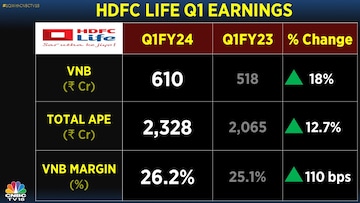

HDFC Life on Friday reported 15.4 percent rise in net profit at Rs 415 crore in the first quarter of FY24 as against Rs 360 crore year-on-year (YoY). The annualised premium equivalent (APE) for the mentioned quarter stood Rs 2,328 crore versus CNBC-TV18 poll of Rs 2,280 crore. In the first quarter of last financial year i.e. FY23, the APE was reported at Rs 2,065 crore.

The net premium income for the first quarter of FY 24 increased 16.6 percent YoY to Rs 11479 crore. The value of new business (VNB) stood at Rs 610 crore versus CNBC-TV18's poll of Rs 625 crore.

This was 18 percent above the VNB reported in first quarter of last financial year i.e. FY23. The VNB margin reported a rise of 26.2 percent, as against 25.1 percent in Q1 of FY23.

The solvency ratio was 200 percent up in the quarter gone by, compared to 183 percent a year ago. Solvency Ratio (SR) measures the financial health of an insurance company and its ability to meet outstanding debt or liabilities. The assets under management (AUM) crossed the Rs 2.5 lakh crore mark as of June 30. The Indian embedded value was 28.9 percent up at 41,843 crore versus Rs 32,471 crore YoY as of June 30.

It's must be noted that YoY numbers have been adjusted for Exide Life merger.

Meanwhile, the board has recommended a dividend of Rs 1.90 per share aggregating to a payout of Rs 408 crore subject to approval by the shareholders.

HDFC Life Management said, “We are now a subsidiary of HDFC Bank post-merger. HDFC Bank owns 50.4% in HDFC Life.”

It said that its market share increased from 12.5% to 16.5% in the private life insurance sector and from 7.2% to 10.8% in the overall life insurance industry.

The company is expecting a stronger second quarter and a similar scenario in the second half of the financial year 2023-24.

The company’s management expressed optimism for the future, anticipating a Value of New Business (VNB) expansion driven by the growth of Annualized Premium Equivalent (APE) in the first quarter of FY24.

While the Protection portfolio witnessed an upward trend, non-participating (non-PAR) segments experienced a decline. The management acknowledged their capability to increase margins but emphasized the importance of retaining market share. As they look ahead, HDFC Life aims to maintain margins at the same level as the previous year, with expectations of growth from the following year onwards.

Shares of HDFC Life closed at Rs 647.25 apiece on BSE, down 2.18 percent.

First Published: Jul 21, 2023 2:26 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM