The banking sector continues to experience a positive trajectory in terms of loan growth, with an impressive year-on-year (YoY) increase of 15.5 percent. However, the sequential growth rate stands at a modest 2.5 percent, signaling a potential slowdown. While lending activity remains robust, banks face challenges in maintaining healthy margins, leading to concerns over net interest margins (NIM) and profitability.

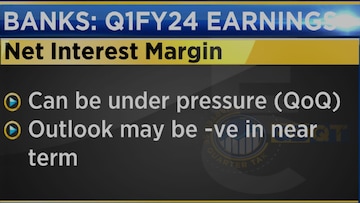

With increased lending activity, banks anticipate some pressure on their net interest margins in the near term. The NIM represents the difference between interest earned and interest expended. Various factors contribute to this potential decline in profitability, including competitive pressure and prevailing market conditions. As a result, the net interest margin is expected to decline by 10 to 20 basis points (bps) in the near term.

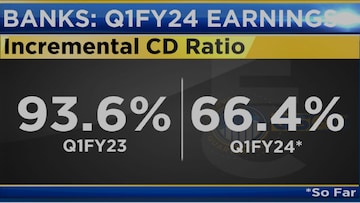

The incremental certificate of credit to deposit ratio (CD ratio) for banks during the

first quarter witnessed a decline. Comparing the data to the same period in the previous fiscal year, the CD ratio dropped from 93.6 percent to 66.5 percent. This lower growth in the issuance of certificates of deposit by banks suggests a potential slowdown in the sector.

Despite the challenges faced by the banking industry, private banks are expected to deliver a strong proforma business update, indicating continued robust performance. These banks are gaining market share, strengthening their position in the banking sector. However, private banks may also experience elevated operating expenses (OpEx) as they invest in expanding their franchises.

The asset quality of banks is projected to improve, primarily due to lower slippage rates. Slippages refer to the deterioration of loans in a specific period. Better recovery efforts will aid in gross non-performing asset (NPA) improvement. Moreover, banks are expected to implement effective measures to manage their

loan portfolios, further enhancing asset quality. Credit costs, which encompass expenses incurred in managing credit risk, are expected to remain lower or under control due to improved risk management practices.

Public sector undertaking (PSU) banks are likely to witness a strong improvement in profitability and return ratios. These banks are making progress in their financial performance, resulting in positive developments in their bottom line. As PSU banks continue their upward trajectory, the overall health of the banking sector is expected to benefit.

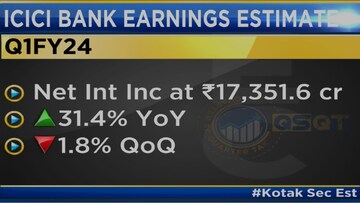

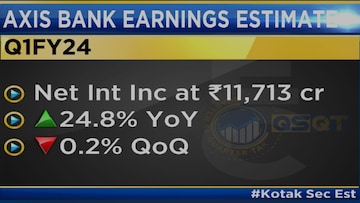

According to Kotak Securities estimates, several key banks are expected to experience notable variations in net interest income (NII) and net profit.

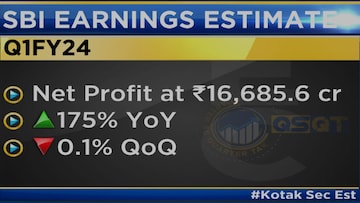

State Bank of India (SBI) is projected to witness a 24.5 percent YoY increase in NII.

Net profit is expected to rise by 175 percent YoY.

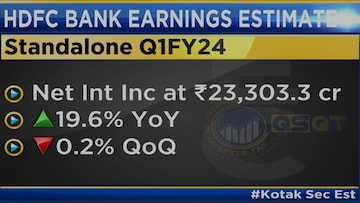

HDFC Bank's NII growth is estimated at 19.6 percent YoY, and net profit is anticipated to increase by 23.7 percent YoY.

ICICI Bank expects a 31.5 percent YoY rise in NII, with net profit increasing by 31.6 percent YoY.

Axis Bank foresees a 24.8 percent YoY increase in NII and a remarkable 39.6 percent YoY rise in net profit.

However, caution should be exercised when comparing these figures with the previous quarter's results, as Axis Bank experienced a significant loss due to the merger of Citi's retail business.

Pranav D Gundlapalle, Senior Research Analyst at Sanford C Bernstein, predicts a healthy first quarter for banks in FY24. While YoY numbers are expected to show continued growth in earnings per share and income, QoQ gains may be relatively muted.

For more details, watch the accompanying video