HCLTech Ltd. will be reporting its September quarter results on Thursday, October 12 and after two successive quarters of negative constant currency revenue growth, that metric may just turn positive.

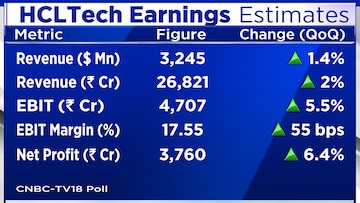

A CNBC-TV18 poll of analysts expects revenue growth in single digits, while the company's net profit may grow in the mid-single digits compared to the June quarter.

HCLTech's constant currency revenue growth is seen at 1.3%, compared to the negative 1.3% it saw during the June quarter.

A significant drop in its Engineering Research & Development (ER&D) revenue led to a decline in the company's June quarter revenue. The ER&D business accounts of 15.4% of the company's overall revenue and that business saw a sequential drop of 5.2% sequentially and 1.8% year-on-year due to project ramp-down in hitech and telecom.

The September quarter will include an inorganic contribution of 0.4% to the company' revenue growth from its ASAP acquisition, while EBIT margin is likely to expand by over 50 basis points from June.

HCLTech is expected to maintain its revenue guidance of 6-8% (Services at 6.5% - 8.5%) but the management may guide towards the lower end of the margin guidance band of 18-19%.

However, analysts believe otherwise.

For financial year 2024, Ambit expects a cut in HCLTech's revenue guidance to 5-7%. Even Nirmal Bang believes that there is a fair probability of the 6-8% growth guidance being revised lower "a tad."

Recently HCLTech had announced that the wage hike cycle would be skipped for the mid-level and senior employees, while that for junior employees has been pushed back to the December quarter.

For the quarter, the company's net new deals are likely to be very high aided by the Verizon deal. That will come after a disappointing TCV number of $1.6 billion in the June quarter.

Last month, the company had announced a $2.1 billion deal with Verizon. This net new deal, spread over six years, will start contributing from November 2023.

While Kotak is forecasting TCV to be $4 billion, Morgan Stanley sees deal wins between $3 billion to $3.5 billion, both comfortably higher than the average of $2 billion over the last seven quarters.

Other Key Factors To Watch:

(Edited by : Hormaz Fatakia)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM