The fast-moving consumer goods (FMCG) sector is providing some relief in an otherwise IT-battered market on Monday. It's looking like the street might see a return of volume growth this time around and some gradual improvement in rural demand. However, it looks like urban areas will still outperform rural ones. And the street might also see some easing in raw material inflation from the last quarter levels itself and that'd be a welcome change.

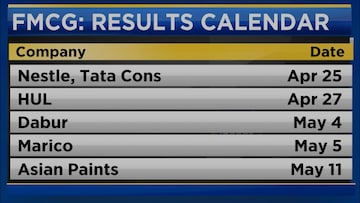

The key result dates for FMCG companies

Nestle and Tata consumer will report results on April 25, Hindustan Unilever Ltd (HUL) will report its results on April 27. Dabur, Marico as well as Asian Paints will report their results between May 4 and May 11.

Quarter four business updates

Titan had an overall growth of 25 percent and a jewellery business growth of 23 percent on a favourable base. Godrej Consumer Products Ltd (GCPL) and Marico both reported similar numbers - double-digit revenue growth, mid-single-digit volume growth and EBITDA growing ahead of revenue.

Dabur was an underperformer there, because of its divergence from the other FMCG companies. Only mid-single-digit revenue growth and margins declined by 200 to 250 basis points (bps).

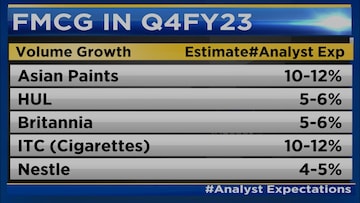

Volume growth expectations

Analysts are expecting Asian Paints to post around 10 to 12 percent volume growth. HUL, Britannia in a middling range of 5 to 6 percent, ITC (cigarettes) likely to grow between 10 and 12 percent in terms of volumes, and Nestle too volume growth of around 4 to 5 percent.

But apart from these numbers, what else the market should be keeping an eye on?

Given the

heatwave, it will be important to watch the performance of summer portfolios of companies, most important in FMCG numbers is not the numbers but the management commentary on-demand recovery. And importantly, see how rural business is expected. Importantly, the market will also watch out for what the company is doing with regards to passing the price cuts to consumers. At the same time, reinvesting their cost reductions into advertisements and marketing to.

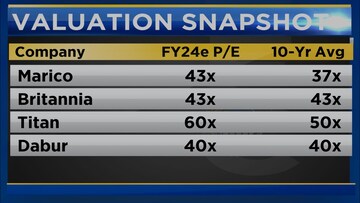

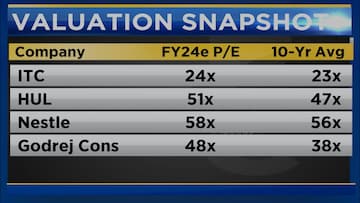

Finally, the FMCG sector which has never been cheap, valuations have always been high, it has been seen the valuations come off their highs, and now they're closer to their 10-year averages than what they've been in the past couple of years.

So case in point Marico’s current valuations are at 43 times, the 10-year average is at 37 times, Titan’s current valuations are at 60 times but the 10-year average is at 50 times and current valuations for Dabur and Britannia have remained the same as their 10-year averages at 40 times and 43 times respectively.

Abneesh Roy, Executive Director at Nuvama Institutional Equities has a strong buy call on ITC, Godrej Consumer, Britannia and HUL.

“We will be having a stronger buy on ITC, Godrej Consumer, Britannia and HUL. So definitely these companies have higher pricing power, more diversified portfolio,” he said.

For more details, watch the accompanying video