The third quarter (October-December) is seasonally the strongest for the consumer sector. There ahs been a noticeable split in how different companies are recovering, a trend often described as a 'K-shaped recovery.' This means that while some businesses are thriving and seeing their stock prices soar, others are not faring as well.

For instance, Titan's stock has risen by 50%, Tata Consumer by 45%, ITC by 38%, and Nestle by 30%. These companies, mainly focused on urban consumers, are the clear winners in this scenario.

The Street has also seen decent gains for the likes of Godrej Consumer Products Ltd (GCPL) on account of the inorganic foray that they made with Park Avenue.

However, if one moves to the rural-focused companies or those in the staples, there have been many underperformers. Hindustan Unilever Ltd (HUL) is down 1.5% in the last 12 months, Colgate Palmolive India is up just 2%.

So what is the Street expecting in the third quarter?

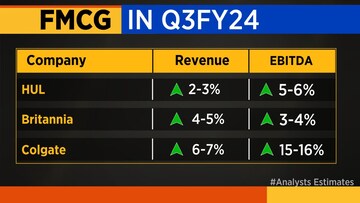

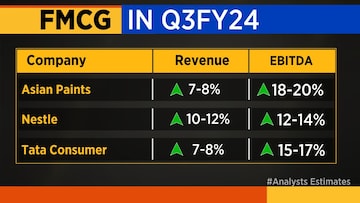

Analysts expect a gradual recovery owing to the festive season with mid-single-digit volume growth for the entire

fast-moving consumer goods (FMCG) pack. The focus will be on whether urban and discretionary consumption continues to thrive, and rural continues to lag, and the problems in the mass market staples business.

However, earnings before interest, tax, depreciation, and amortisation is expected to be better.

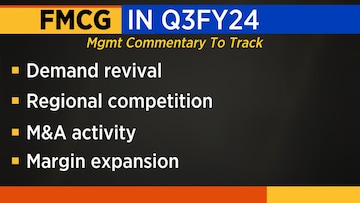

Analysts will keep an eye on a couple of other things. A potential price decrease with commodity prices cooling off could weigh on the revenue of all companies. Street will also closely watch if there is expansion in the gross margins, and regional competition trends which may have results in enhanced ad spends.

What are the industry updates so far?

Titan has reported a 23% jump in its jewellery business. This means the discretionary demand is doing a lot better. Avenue Supermarts saw a 17% jump in its standalone revenue but a lot lower than its four year average. Again, mass consumption appears to be under pressure.

What are the important things to watch out for apart from the numbers?

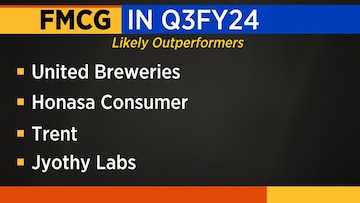

One will have to watch out for a couple of these likely outperformers. For instance, United Breweries management told CNBC-TV18 it expects a margin expansion and volume uptick. Honasa Consumer also talked of a potential margin uptick. The outlook is also good for Trent that has had a strong run.

Management commentary on demand revival, regional competition, mergers and acquisitions (M&A) activity and margin expansion will be closely watched.

Valuations have never been cheap in the FMCG space, but now it looks relatively better given the run-up that has been seen in the other spaces.

Industry experts have been concerned about the upcoming year, foreseeing a slowdown rather than an uptick in the market.

Vishal Gutka, AVP-Consumer & Media at Phillip Capital, highlighted the prevailing challenges in the industry, emphasising the ongoing stress in rural demand and the absence of meaningful signs of recovery.

Gutka explained that the entire ecosystem, spanning from consumers to distributors, is grappling with various issues, causing a sense of discomfort. He noted that regional brands seem to be faring better than their national counterparts, attributing their success to their ability to meet customer needs and cater to the demands of local mom-and-pop stores. In the current market scenario, customers are seeking lower prices, while retailers are in need of higher margins and extended credit periods. Regional brands, according to Gutka, are better positioned to fulfill these requirements.

The performance of specific FMCG companies has been highlighted in the analysis. Nestle and Tata Consumers continue to outperform, while Jyothy Labs has been commended for its excellent execution of distribution ramp-up. On the jewellery side, Titan is anticipated to report strong numbers.

Gutka suggested top picks for the medium-term perspective, with GCPL standing out in the midcap space. He also expressed continued favor towards Nestle and ITC in the large-cap space.

In terms of the paints space, experts believe that the sector might experience time corrections due to increased noise in the market.

For more, watch the accompanying video