Hyderabad-based fintech company, Zaggle Prepaid Ocean Services is targeting revenue growth of over 40% in the next financial year (FY25) and is on the cusp of announcing large partnerships with banks. In an interview with CNBC-TV18, Avinash Godkhindi, Co-promoter, MD & CEO said, “Our corporate base is growing, we are also working very diligently on our cross-sell and that is showing great results.”

Zaggle creates top-tier financial solutions and products designed to streamline the management of corporate, SME, and startup business expenses, utilising automated and inventive workflows.

Talking about their collaboration with Visa, Godkhindi said that the plan is to launch a forex card under a five-year partnership agreement. This partnership, valued at approximately $20 million in incentives based on spending, is slated to roll out in the coming quarters.

Zaggle offers three key products: Propel, Save, and Zoyer. Zoyer, one of their flagship offerings, integrates accounts payable and credit card transactions into a unified platform, enabling enterprises to manage business-to-business payments more effectively and optimize cash flow.

Also Read

Zaggle Propel serves as a comprehensive solution for employee rewards and channel partner incentives, while Save facilitates tax savings for employees through versatile benefit schemes. By digitising employee tax benefits with a single card, Zaggle provides a seamless alternative to traditional items like food coupons, fuel cards, and gift vouchers.

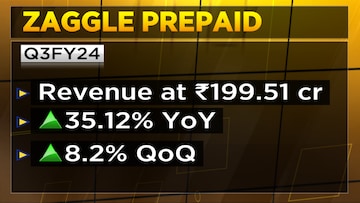

The company reported a strong set of third quarter numbers for the current financial year (Q3FY24) with revenue growing 35.12% year-on-year (YoY) to ₹199.51 crore. Earnings before interest, tax, depreciation, and amortisation (EBITDA) jumped 176% YoY to ₹20.4 crore with margin at 10.2%.

The stock has gained 26% over the past month. The company has a market capitalisation of ₹3,281.96 crore.

For more details, watch the accompanying video

(Edited by : Shweta Mungre)