Subhrakant Panda, Managing Director of Indian Metals & Ferro Alloys (IMFA), has indicated that the company's earnings could be impacted by the economic downturn in China, which has led to a global decrease in stainless steel production and, consequently, a dip in ferrochrome prices.

In a discussion with CNBC-TV18, Panda noted, “If you look at where we stand in Q3 versus Q2, prices have gone down a bit more, all of this is reflective of the fact that China is going through a period of stress, there is de-growth in stainless steel production of about 1.7% or so, globally. So all of that is leading to a gradual decline in realisations for ferrochrome as well.”

However, Panda pointed out a silver lining, stating that the fall in realisations is being balanced by a drop in input costs. He remains optimistic about the company's performance, projecting EBITDA (earnings before interest, tax, depreciation, and amortisation) margins of 20% or more for the second half of the fiscal year, which he believes will lead to a strong annual performance.

IMFA produces ferro chrome, used to make stainless steel, and has an installed furnace capacity of 190 MVA (2,84,000 metric tonnes per annum) at its two plants at Therubali and Choudwar in Odisha.

On Thursday, November 2, IMFA reported a fivefold increase in its consolidated net profit for the September quarter to ₹89.34 crore, primarily due to reduced expenses. This is a marked improvement from the ₹16.40 crore net profit of the same quarter last year. The company's total income also saw an increase to ₹704.25 crore from ₹676.88 crore year-on-year.

The company has managed to lower its operating costs significantly, thanks to decreased expenses on inputs like thermal coal for power generation and metallurgical coke for smelting. Panda credits these reduced costs for the company's improved margins.

He also highlighted the company's strategic advantages, saying, “We benefit from having captive chrome ore mines, a significant strength for us. Additionally, we operate with a fully integrated setup and a debt-free balance sheet. In a scenario where interest rates are rising, these factors have combined to produce a strong set of results considering the circumstances.”

The board of the company approved an interim dividend of ₹7.50 per equity share of ₹10 each for the financial year ending March 31, 2024. It also approved the merger of Utkal Coal into Indian Metals & Ferro Alloys. The amalgamation will be implemented on receipt of requisite approvals of statutory and regulatory authorities, including the approval of the jurisdictional National Company Law Tribunal, shareholders and creditors.

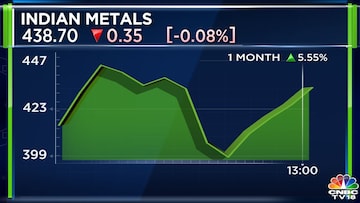

IMFA has a market capitalisation of ₹2,363 crore.

-With inputs from PTI

(Edited by : Shweta Mungre)