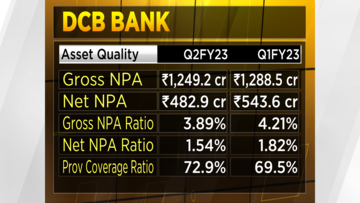

DCB Bank’s September quarter results saw its asset quality improve on a sequential basis. The bank reported its best-ever current account/savings account (CASA) ratio while net interest margin (NIMs) 3.88 percent turned out to be the highest in 17 quarters. However, slippages at Rs 455 crore remained elevated for the seventh straight quarter.

“We expect the slippage ratio to continue to be slightly higher for at least two more quarters before it settles down to pre-COVID levels,” said Murali M Natarajan, MD & CEO, DCB Bank while speaking to CNBC-TV18.

For the September quarter, provisions declined 11.5 percent to Rs 31 crore from the June quarter. The net interest income (NII) or the bank's core income rose 27 percent from last year while advance growth stood at 17 percent year-on-year. Mortgages contributed to a majority of the lender's loan mix.

The bank's net profit rose 73 percent from last year to Rs 112.35 crore. On a sequential basis, the bottom line grew by 15 percent.

Meanwhile, the bank’s restructured book is performing well. “We never restructured unsecured portfolio. The majority of our restructured portfolio is secured portfolio,” Natarajan said.

The bank expects its portfolio to grow steadily with the management targeting to double its balance sheet in the coming three-four years.

However, as far as the credit cost is concerned, whether restructured or the good book, everything is reflected in the credit cost, the management mentioned.

The bank has given a credit cost guidance of about 50-55 basis points (bps), which is pre-COVID credit cost.

In terms of loan growth, from 2010 to 2020, the bank has grown at a compounded annual growth rate (CAGR) of 22 percent. “We are trying to put the trajectory back to pre-COVID levels. That is why I am guiding that we expect our loan book to double in about three and a half years’ time with credit cost of approximately 50 bps,” he explained.

DCB Bank does not expect to raise capital for at least the next year. Once the bank sees the growth that the management is expecting, it will consider capital raising after one year.

The stock was up 11.20 percent in the last week and up 17.06 percent in the past month. Currently it is trading near its 52-week high of Rs 122.60.

For the full interview, watch the accompanying video.