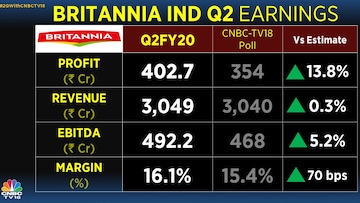

Britannia Industries is the top Nifty gainer in today’s trading session after reporting a solid operating performance in the second quarter. In an environment of higher input costs, especially in milk, maida and sugar, the fast-moving consumer goods company has managed to improve gross margins as against Street expectations of a contraction.

Domestic volume growth trend

Q1FY19 12.5%

Q2FY19 12%

Q3FY19 7%

Q4FY19 7%

Q1FY20 3%

Q2FY20 3%

The company has managed to do this by pro-actively hedging themselves by pre-booking input commodities. This, coupled with their accelerated drive on cost efficiencies and leveraged fixed costs, resulted in the highest ever quarterly EBITDA posted by the company.

On the profit front, just like most companies this time, the booster shot came from the finance minister’s tax cut announcement. Britannia’s Q2FY20 effective tax rate fell from 34 percent to 19.2 percent YoY. That led to a 33 percent jump in their quarterly profit over last year.

What the management says

According to the management, the company continued to grow faster than the market. It has witnessed moderate inflation in the prices of key raw materials for the bakery business. There was an inordinate increase in milk prices which impacted its dairy business.

It has accelerated the drive on cost efficiencies and leveraged fixed costs. Despite sluggish demand, Britannia continued to invest in enhancing brand equity.

Also, for Britannia, it’s important to watch for developments beyond the bottom-line and into the balance sheet. On the liability side, one would’ve noticed a big jump in both, long-term and short-term borrowings. This can be explained.

Long-term debt was primarily just the Rs 720 crore bonus debentures issued by the company and not any fresh borrowing, so that shouldn’t concern investors.

Stocking up on inventory

As far as short term debt is concerned, it jumped from NIL to Rs 500 crore in six months. There has been a commensurate rise in inventories so it can be easily assumed that they borrowed short term money to stock up on inventory for protection against inflation.

This has worked well for them in the past, and if inflation continues, this will help them against competition. However, were the prices to fall, they do stand the risk of sitting on high cost inventory, though the possibility of that looks less.

On the asset side, issues related to inter-corporate deposits to stressed Wadia Group entities was a concern among investors. Those pressures seem to have ameliorated a bit, given a small decline in loans receivable from March to September.

The key question that now needs to be explained by the management is the increase in long term investment. The company should reveal the instrument and the recipients of this in their conference call slated on November 15.

Balance sheet (September vs March)

Long Term Borrowings at 721 Cr vs 0.26 Cr

Short Term Borrowings at 500 Cr vs NIL

Loans Receivable at 842 Cr vs 1121 Cr

Short Term Investments at 578 Cr vs 595 Cr

Long Term Investments at 1443 Cr vs 1051 Cr

Despite today’s up move, Britannia has been an underperformer as compared to most of its peers in the Nifty (barring ITC). So may be the street will perhaps take a re-look at their growth prospects into macro snacks and the relatively newer dairy business going forward.

At current reckoning, valuations of 49X FY21e P/E do seem prohibitive, but, as compared to peers like Nestle and HUL, there does seem a slight headroom.

First Published: Nov 13, 2019 1:43 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi confident of BJP sweeping Bihar and UP, banks on 'sympathy' in Maharashtra

Apr 29, 2024 9:38 PM

Exclusive: Can't fix elections in India, not even for a municipality, says PM Modi on Opposition charges

Apr 29, 2024 9:25 PM

Supreme Court dismisses plea seeking postponement of CA exams; details here

Apr 29, 2024 2:29 PM

Just 8% women candidates contested first two phases of Lok Sabha polls

Apr 29, 2024 12:00 PM