FMCG major Britannia Industries Ltd on Tuesday (February 6) reported a 40.4% year-on-year (YoY) decline in net profit at ₹555.7 crore for the third quarter that ended December 31, 2023.

In the corresponding quarter last year, Britannia Industries posted a net profit of ₹932.4 crore, the company said in a regulatory filing. CNBC-TV18 poll had predicted a profit of ₹550 crore for the quarter under review.

The company's revenue from operations increased 1.42% to ₹4,256.3 crore against ₹4,196.8 crore in the corresponding period of the preceding fiscal. CNBC-TV18 poll had predicted a revenue of ₹4,300 crore for the quarter under review.

At the operating level, EBITDA increased 0.4% to ₹821.1 crore in the third quarter of this fiscal over ₹817.6 crore in the year-ago period. CNBC-TV18 poll had predicted an EBITDA of ₹815 crore for the quarter under review.

The EBITDA margin stood at 19.3% in the reporting quarter against 19.5% in the corresponding period in the previous fiscal. EBITDA is earnings before interest, tax, depreciation, and amortisation. CNBC-TV18 poll had predicted a margin of 19% for the quarter under review.

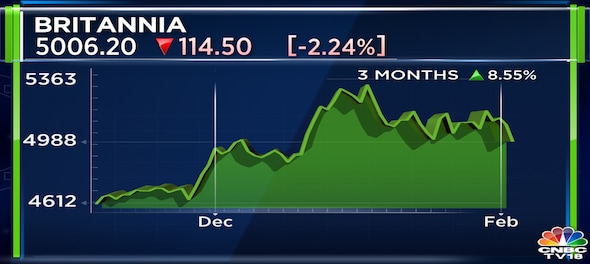

The results came after the close of the market hours. Shares of Britannia Industries Ltd ended at ₹5,006.20, down by ₹114.50, or 2.24%, on the BSE.