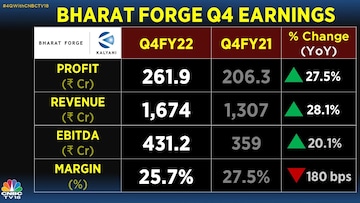

Auto components major Bharat Forge Ltd on Monday reported a 27.5 percent increase in its net profit at Rs 261.9 crore in the fourth quarter ended March 2022. The company had posted a net profit of Rs 206.3 crore in the same period of the preceding fiscal, Bharat Forge said in a regulatory filing.

Revenue during the quarter under review stood at Rs 1,674 crore as against Rs 1,307 crore in the year-ago period, it added.

CNBC-TV18 Polls had predicted a profit of Rs 247 crore and revenue of 1,579 for the quarter under review.

In the entire fiscal year ended on March 31, 2022, the company's consolidated net profit was at Rs 1,077.06 crore. It had posted a consolidated net loss of Rs 126.97 crore in FY21. For FY22, revenue from operations was at Rs 10,461.08 crore as compared to Rs 6,336.26 crore, it added.

Bharat Forge said its board of directors, at a meeting held on Monday, has recommended a final dividend of Rs 5.50 per equity share of Rs 2 each at 275 percent for the financial year ended March 31, 2022.

Speaking to CNBC-TV18, Bharat Forge chairman and managing director Baba Kalyani said that he expects the electric vehicle business to grow exponentially in the coming years. “It all depends on how fast the EV transition takes place, but by 2025 our EV component business and electronics business will be almost as big as our existing business,” he said.

Kalyani also said the company does not see raw material prices as a problem. “In our system, raw material prices are a full pass-through to our customers. So that is not an issue. I think we are beginning to see, some levelling up of raw material prices. So we don't see that as a problem,” he said.

In an investor presentation, Kalyani said, "In FY22, the Indian operations have secured new orders worth around Rs 1,000 crore across automotive and industrial applications. This includes a healthy mix of existing and new customers across traditional and new products."

In the international operations, he said, new orders worth USD 150 million have been secured across steel and aluminium forging operations in North America. "These order wins from marquee OEMs (Original Equipment Manufacturers) provides a lot of growth visibility in the medium to long term. The EV (Electric Vehicle) vertical has secured orders from a global EV OEM for supply of aluminum castings and its maiden order from an Indian OEM for supply of DC-DC converters," Kalyani said.

On the outlook, he said, "At a consolidated level, we expect FY23 to be a strong year characterised by top-line growth coupled with strong cash flows, ramp-up of the US aluminium operations, revenue contribution from the newer verticals and a further diversified revenue mix."

For the standalone business, the company expects continued growth in the key markets across all sectors. The easing of cost pressures and supply chain tightness will provide a fillip to the end demand across geographies.

With inputs from PTI

(Edited by : Priyanka Deshpande)

First Published: May 16, 2022 3:50 PM IST