Bharat Forge net profit jumped almost 31% to ₹377.8 crore in the quarter ended December 31, 2023, driven by a favourable product mix and focus on cost optimisation. The company had reported a net profit of ₹289.1 crore in the October–December period of the last fiscal.

Bharat Forge revenue also increased by 16% to ₹2,263.3 crore on a year-on-year basis in the period under review. It had posted a revenue of ₹1,952.1 crore in Q3FY23.

Bharat Forge EBITDA (earnings before interest, taxes, depreciation, and amortisation) also rose 24% to ₹663 crore in Q3FY24, against ₹535.1 crore in the same quarter a year ago. Bharat Forge's margin for the quarter came in at 29.3% compared to 27.4% in the quarter a year ago.

#3QWithCNBCTV18 | #BharatForge reports Q3 earnings 👇

>>Net Profit up 30.7% at ₹377.8 cr Vs ₹289.1 cr (YoY)>>Revenue up 16% at ₹2,263.3 cr Vs ₹1,952.1 cr (YoY)>>EBITDA up 24% at ₹663 Cr Vs ₹535.1 cr (YoY)>>Margin at 29.3% Vs 27.4% (YoY) pic.twitter.com/RhzzH4raun— CNBC-TV18 (@CNBCTV18Live) February 12, 2024

During the quarter, the company secured new business worth ₹550 Crores across Automotive, Industrial, Defence, Aerospace and Castings (Ferrous & Aluminum).

The company said its board has accorded in-principal approval to raise funds not exceeding ₹500 crore through term loan, non-convertible debentures or any other debt instruments.

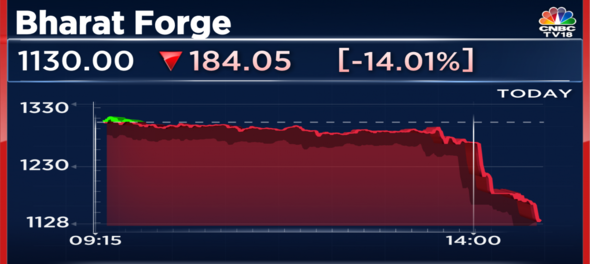

Bharat Forge shares post biggest single-day drop since March 2022—Here's why

Bharat Forge shares posted their biggest single-day drop since March 2022, tumbling more than 14% in a weak market that saw a sell-off across sectors. The management commentary also pointed at moderation in the growth momentum in Q4FY24 and beyond.

"Looking ahead in Q4 and further into FY25, we expect the growth momentum to moderate in both the domestic and export markets across industries," Bharat Forge Chairman and Managing Director Babab Kalyani said in a regulatory filing. The company's endeavour will be to outperform the market driven by its diversified business mix, he added.

“Our commentary is derived from what we hear from our customers. Our export markets are largely in Europe and the US and both markets are seeing some amount of cyclical peaking. Europe is also under other pressures, right from cost increases due to geopolitical events in their vicinity and lots of fundamental changes in the overall European marketplace,” Amit Kalyani, Deputy Managing Director of Bharat Forge told CNBC-TV18 on Monday.

“US exports will be positive because it is going to be driven by infrastructure growth, elections are going to happen, so there will be some push for growth... Sectors that were largely driven by China are going to see pressure. That is something that will play out for all companies, we are just being prudent and calling it out upfront because we believe in long-term rather than quarter-to-quarter kind of business,” he added.

“On the growth side, 10% growth is still on the cards. If things work out better, then it could be even higher than that,” he further added.

Bharat Forge dividend news

Bharat Forge also announced an interim dividend of ₹2.50 per equity share, which translates into 125% of the face value of ₹2 each of the company. The company has fixed February 23 as the record date for determining eligible shareholders for the interim dividend payout, which could be credited on or before March 12.

For the year ending March 2023, Bharat Forge has declared an equity dividend of 350.00% amounting to ₹7 per share. At the current share price of ₹1,130.95 this results in a dividend yield of 0.62%. The company has a good dividend track report and has consistently declared dividends for the last five years.

| Announcement Date | Ex-Date | Dividend Type | Dividend (%) | Dividend (Rs) |

| 4/5/2023 | 7/7/2023 | Final | 275 | 5.5 |

| 14-11-2022 | 24-11-2022 | Interim | 75 | 1.5 |

| 16-05-2022 | 14-07-2022 | Final | 275 | 5.5 |

| 12/11/2021 | 25-11-2021 | Interim | 75 | 1.5 |

| 4/6/2021 | 15-07-2021 | Final | 100 | 2 |

| 18-02-2020 | 3/3/2020 | Interim | 100 | 2 |

| 8/11/2019 | 20-11-2019 | Interim | 75 | 1.5 |

| 20-05-2019 | 1/8/2019 | Final | 125 | 2.5 |

| 2/11/2018 | 15-11-2018 | Interim | 125 | 2.5 |

| 22-05-2018 | 27-07-2018 | Final | 125 | 2.5 |

First Published: Feb 12, 2024 2:10 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM