Shares of Bharat Forge declined over 3 percent in intraday trade on Friday after the company reported its fourth quarter results which were a miss on all fronts. The stock is trading at the day's lows.

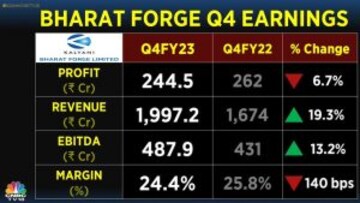

On a standalone basis, for the fourth quarter of financial 2022-23, the revenues rose 19 percent to Rs 1,997 crore on a year-on-year basis, but is lower than CNBC-TV18 poll of Rs 2,048 cr. Company says, the revenues of Rs 1,997 crore is the highest so far with sales increasing across all business areas and regions.

Earnings before interest, tax, depreciation and ammortisation was higher by 13 percent year on year and rose to Rs 488 crore, when compared with Rs 431 crore reported in same quarter last year. It is also lower than the CNBC-TV18 poll of Rs 546 crore.

Operating profit margin at 24.4 percent was also lower than estimates of 26.7 percent. The company's net profit of Rs 245 crore is much below estimated Rs 327 crore.

The company reports a one time loss of Rs 41 crore versus 2.5 crore in same quarter of last year. The company's other expenses surged to Rs 505 crore versus Rs 390 crore on a year on year basis. The other expenses of Rs 505 crore includes a forex loss of Rs 35 crore in fourth quarter.

Overall export revenues to Europe, Americas and Asia Pacific is higher by 26 percent to Rs 1,180 crore. Export revenue growth at 26 percent was higher than the domestic revenue growth of 11 percent in the fourth quarter. The commercial vehicles exports in fourth quarter grew 26 percent year on year basis to Rs 505 crore, while passenger vehicles export revenues grew 47 percent to Rs 252 crore. Though inflationary and energy pressures have abated in Europe, they still continue to be higher than the steady state levels.

For the full financial year 2022-23, the company clocked order wins of about Rs 4,000 crores across Defence and castings. The company reiterates that it has been a tough year for the overseas subsidiaries which recorded an EBITDA loss of Rs 96 crore, due to ramp up challenges on the new Aluminium forging facilities coupled with cost under recoveries. Although for financial year 2023-24, the company expects strong growth across revenues, profitability and return ratios, driven by the core forging business supported by all other platform businesses (Defence, Industrial & E-Mobility). "The troubles ailing the overseas Aluminum business is over and expect them to be contribute to improvement in Return Ratios for the consolidated entity".

The stock is 14 percent lower on a year to date basis.

First Published: May 5, 2023 1:03 PM IST