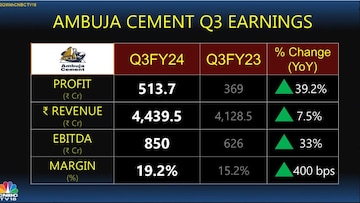

Cement maker Ambuja Cements’ net profit rose 39.2% year-on-year to ₹513.7 crore but missed CNBC-TV18 poll estimates, according to the quarterly earnings report released by the firm on January 31.

The Adani Group firm’s revenue for the third quarter of the financial year rose 7.5% to ₹4,439.5 crore compared to ₹4,128 crore in the same period a year ago. The analysts polled by CNBC-TV18 had pegged revenue at ₹4,399 crore.

Ambuja Cements' margin also expanded by 400 basis points year-on-year to 19.2% from 15.2% earlier. The earnings before interest, taxes, depreciation, and amortisation (EBITDA), meanwhile, has risen 33% YoY to ₹850 crore for the December 2023 ended quarter. The firm also highlighted that the third quarter’s EBITDA margin is the highest in the last 10 quarters.

In the Q3 results statement, the firm pointed out that in December 2023, Ambuja Cements completed the acquisition of Sanghi Industries having a 6.1 MTPA capacity. This month, Ambuja’s subsidiary ACC completed the acquisition of the balance 55% stake in Asian Concretes and Cements Private Ltd (ACCPL) having 2.8 MTPA capacity.

“These acquisitions reinforce the Adani Group’s market leadership and take its cement capacity to 77.4 MTPA, a jump of 15% from last year. Integration of these acquired companies is going on well,” the firm said in its statement.

Also Read: Sanghi Industries' operating profit per tonne will match Ambuja's in two years, says Karan Adani

Ambuja Cements explains that sustained cost reduction and efficiency improvements, volume expansion, and group synergies have contributed to profitability improvement.

The statement comes as the company recorded sales volume growth of 3% driven by ground network improvement, focus on micro markets, addition in the ground sales team, improved physical infrastructure, targeted marketing campaigns with technical support services, high acceptance of premium products (22% of trade sales volume) and accelerated branding and promotion activities.

It also noted that power and fuel costs have reduced by ₹349/t of cement. Other expenses, it said, were maintained or were marginally higher due to the phasing of the planned shutdown, advertisement and promotion expenses.

Following the results, Ambuja Cements shares at 1:53 pm were trading at ₹559, which is 2.02% lower than their previous close on BSE.

(Edited by : Amrita)

First Published: Jan 31, 2024 2:03 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Delhi voters can avail free rides from booths to their homes on polling day

May 10, 2024 6:26 PM

Kolkata North: TMC fights 'TMC' in battle reflecting party's Old vs New debate

May 10, 2024 5:14 PM