The resurgence of volatility in the equity market has forced investors to seek the safety net provided by precious metals such as gold and silver. As a result, gold-backed cryptocurrencies have also seen a surge in prices.

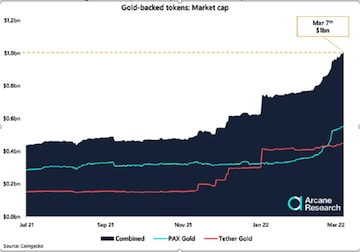

On March 7, the two prominent gold-backed tokens -- PAX Gold (PAXG) and Tether Gold (XAUt) -- crossed the market capitalization of $1 billion combined, data accessed by CoinDesk shows. The following day PAXG touched $2071 (within inches of its all-time high of $2083) while XAUt touched $2071, as per CoinMarketCap data. However, at the time of writing this copy, both tokens had slipped below the $2000-mark, down over 2 percent each over 24 hours. Their combined market capitalization stood at about $811 million.

“The rallying gold price seems to have attracted more crypto investors to the gold-backed tokens,” said Arcane Research in its latest weekly note.

The two tokens have rallied by 60 percent year-to-date (YTD), piggybacking on the threat of impending “specter of stagflation” said Arcane Research. This is at a time when the global market capitalization of all cryptocurrencies combined has dropped by 20%, from $2.2 trillion to $1.75 trillion, during the same period, as per CoinMarketCap.

“Stagflation is a serious risk, and higher and longer inflation is close to a certainty,” said Singapore’s Monetary Authority early on March 9, as reported by ForexLive.

In economics, stagflation is a situation marked by high inflation, high unemployment and slow economic growth.

The Russia-Ukraine war has created a supply shock for the global economy which has led to inflationary pressure in the face of surging energy and food prices. Crude oil prices rose to $130 per barrel – the highest level observed since the 2008 economic crisis.

Typically, a stagflationary environment is bad for stocks. However, safe havens such as gold and silver tend to do well during such periods. This is because inflation erodes the purchasing power of currency which in turn makes gold more expensive. Hence, gold gains, and so do the gold-backed cryptocurrencies.

“Stagflation and gold are better bedfellows than anything you will read in 50 Shades of Grey, and once gold comprehensively broke $2000.00 overnight, the rally accelerated sharply as expected. Gold rocketed 2.63 percent higher to $2050.00 an ounce, edging slightly higher to $2053.00 in Asia,” said Jeffrey Halley, Senior Market Analyst, Asia Pacific at OANDA. “The stagflationary factors that are so supportive of gold are persisting and will remain so,” he added.

The yellow metal has already gained 10% YTD to trade just under $2000 per ounce. On March 8, gold touched $2049.85, narrowly missing its all-time high of $2075, registered in August 2020. Both gold-backed crypto tokens, the PAXG and the XAUt, represent “one fine troy ounce of gold.”

Since February 24 when Russia invaded Ukraine both PAXG and XAUt have seen a significant rise in prices. PAXG rose by 7% in the following 12 hours, and XAUt jumped by 3% in the same period.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Just 8% women candidates contested first two phases of Lok Sabha polls

Apr 29, 2024 12:00 PM

The sexual assault case against Prajwal Revanna — here's what we know so far

Apr 29, 2024 11:36 AM

Repolling underway at one polling booth in Chamarajanagar LS segment in Karnataka

Apr 29, 2024 10:32 AM