Bitcoin continues to hover around the $21,000-mark and is grappling with bearish investor sentiment. The flagship cryptocurrency cannot seem to keep its head above water as massive investor selloffs keep the price from rebounding. Bitcoin even declined to an 18-month low, falling below $18,000 earlier this month.

However, one sign that could offer some reassurance is the amount of Bitcoin held on exchanges. According to Glassnode data, Bitcoin balances held by exchanges fell to a 3-year low of 2,384,477 BTC yesterday.

The amount of exchange-held Bitcoin is an indicator of the overall market sentiment. Generally, the supply of bitcoin on exchanges jumps when BTC is transferred to exchanges to be sold. Recent figures back this notion, with the largest inflow of Bitcoin since 2018 being recorded on June 14, 2022. Five days later, BTC hit a low of $17,744.

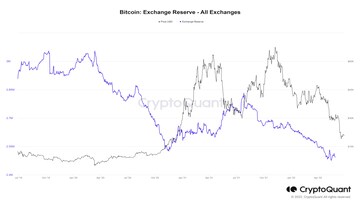

On the other hand, the last time Bitcoin exchange reserves hit an all-time low (3 years ago), the price of Bitcoin took off. It was a similar story in September 2021: Bitcoin held on exchanges began to plummet, and prices began to rally, eventually leading to an all-time high for the legacy coin. This inverse relation between exchange-held Bitcoin and prices can be seen in the chart below:

The Glassnode post also reveals that the previous 3-year low of 2,384,519 BTC was observed as recently as two days ago. This shows that exchange-held Bitcoin is on a gradual decrease.

Amid these trying times, another interesting and encouraging metric has come to light. Investors are looking to buy the dip and add to their BTC stockpile while prices are low. Glassnode reported that the number of ‘non-zero wallets’ touched an all-time high (ATH) of 42 million. Moreover, the number of Bitcoin wallets holding one or more BTC also touched an ATH of 870,762.

However, it’s not all good news. According to Coinshares data, Bitcoin-specific funds have witnessed a $453 million outflow in the last week. An outflow is when investors sell their crypto-based funds and this is often a bearish sign.

Also Read:

This latest outflow has more than neutralised any inflows during the previous six months. And according to the report, Toronto-based Purpose Investments’ crypto products contributed to the lion’s share of the losses, suffering a whopping $490.7 million outflow in the last week. This could be due to the recent 0.50 percent rate hike by the Bank of Canada.

All-in-all, the total Bitcoin assets under management (AuM) currently stand at $24.5 billion — the lowest in 18 months. Bitcoin is currently trading at $20,968 — shedding 2.4 percent over the last 24 hours and 70 percent since the ATH of $69,000 from November 2021. Bitcoin’s market capitalisation is $396.65 billion at the time of writing.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!