The Shriram Group has formally announced the structure of the merged entity on Monday. Shriram Finance — created out of the merger of Shriram Transport Finance, Shriram City Union Finance and ex-holding firm Shriram Capital — has become operational and is looking at growing its non-vehicle financing book faster going forward.

Speaking to CNBC-TV18, YS Chakravarti, MD & CEO, Shriram City Union Finance said that the merger will reflect in two weeks, probably mid of December.

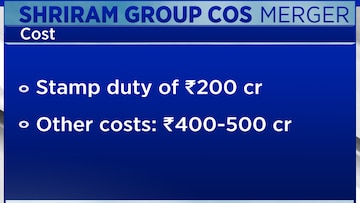

He added that the total cost of merger would be about Rs 500 crore. He said, “The stamp duty costs is about Rs 200 crore odd and the total cost of the merger would be between Rs 400 and 500 crore.”

After the merger, Shriram Finance will emerge as second largest NBFC with an assets under management of over Rs 1,71,000 crore. The company also announced that Umesh Revankar has been appointed as Executive Vice Chairman of Shriram Finance, and YS Chakravarti was appointed as MD & CEO of Shriram Finance for 3 years.

The company sees lower funding cost as the merged entity will get Shriram Transport's AA+ rating and also sees synergies of selling more products to existing set of customers.

Chakravarti said, “The immediate benefits, what I am looking at is our ability to increase our penetration of SME loans, and also increase in gold on branches, where we can actually leverage on the network of Shriram, Transport finances, branches, and experience of that team.”

Umesh Revankar, Vice Chairman & MD, Shriram Transport Finance said, “We believe that increasingly the customers are also getting exposed to multiple products. No more that customer is just focused on a single product and he also has multiple requirements. So we feel that with this merger we will be able to meet all these requirements or all their needs or services.”

The company is heavily dependent on used-commercial vehicle finance and its overall vehicle finance vertical contributed 77.5 percent of its over Rs 1.71 lakh crore loan book now.

Watch video for more

(Edited by : CH Unnikrishnan)

First Published: Dec 6, 2022 1:48 PM IST