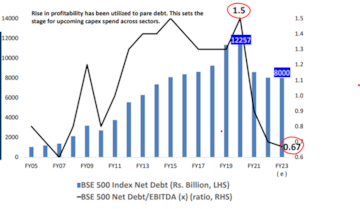

The sharp rise in profitability coupled with prolonged lower interest rates till April last year has brought down India Inc's indebtedness to a six-year low. The net borrowings of BSE500 companies have been on a decline post pandemic after hitting a multi-year high.

The combined net debt of Indian companies is expected to drop to Rs 8 lakh crore by March-end from a staggering Rs 12.26 lakh crore reported at the end of FY20. Falling debt level has also improved overall credit ratio. At 0.67x, the leverage indicator net debt to EBITDA have halved from pre-Covid levels.

According to DSP Investment Managers, rise in profitability has been utilised to pare debt and the same has set the stage for upcoming capex spend across sectors. “This augurs well for the CAPEX cycle, as a healthy balance sheet and strong profitability open the door for corporate India to spend more”, wrote DSP Investment Managers in an investor note. It is quite likely that the government's capex push is complemented by private sector capex and is likely to boost sectors involved in infrastructure and ancillary services.

Also Read: Rs 1,800 Crore market cap gone in five minutes - Biocon has 2.3% equity change hands in a block deal

The aggregate net profit of 2,817 common companies surged 51.2 percent in FY22 to Rs 12.13 lakh crore, whereas the bottom-line of the sample increased by 24.3 percent to Rs 126 lakh crore, data sourced from Bloomberg showed.

However, higher inflation-led interest rates and uncertain macro environment has once again put pressure on corporates’ ability to strengthen their balance sheet. The interest coverage ratio (ICR) of 383 companies from BSE500 index (excluding banks and financials) stood at 6.2 times in three months ended December 2022. That compares with 7.8 times reported a year ago.

The Reserve Bank of India has raised rates multiple number of times over the past 10-odd months in a bid to contain the elevated and sticky inflation. The benchmark rate has gone up as much 250 basis points (bps) since May last year to 6.5 percent. Moreover, a rout in domestic bond markets due to extended monetary tightening cycle has also increased borrowing costs for many corporate as yields on bonds issued by them have shot up.

Source: Bloomberg, Data as on Feb 2023

Source: Bloomberg, Data as on Feb 2023Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM