On June 24, Zomato’s board gave its go-ahead for the Deepinder Goyal-led company to acquire the e-grocery startup Blinkit (formerly Grofers), which was founded by his long-time friend and former ‘Zoman’ Albinder Dhindsa.

Friends from their student days at IIT-Delhi, Dhindsa also led Zomato’s global operations for a few years before venturing out to start Grofers in 2013. The coming-together of the two hyperlocal delivery startups was anticipated for the better part of the year gone by.

In an all-stock deal, Zomato is swapping shares with Blinkit, valuing the grocery delivery platform at USD 568 million. Zomato has cut Blinkit’s valuation nearly in half since turning the e-grocer into a unicorn in a USD 120 million funding round co-led with Tiger Global last August.

"Even globally, we are seeing that food delivery and quick commerce are converging," said Zomato's CFO Akshant Goyal (a not-so-subtle reference to domestic rival Swiggy and its Instamart...).

The founder and CEO Deepinder Goyal sees Blinkit as a natural extension of his food delivery startup. Why? “It is also a hyper-local business, just like food delivery.”

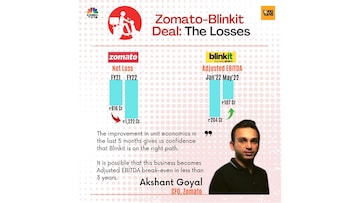

It is the case of one loss-making company acquiring another loss-making company. Leaving aside its own financials, Zomato’s management is drawing confidence from the narrowing of Blinkit’s adjusted EBITDA from Rs 204 crore in January to Rs 107 crore in May. The reason: better unit economics through cost-cutting measures such as shuttering 50 ‘unviable dark stores’ over the same time period.

It’s been tough for Blinkit, facing the aggressive Zepto, Swiggy’s Instamart, Tata-backed Big Basket and Reliance-funded Dunzo. In February, a big cash crunch even led Zomato to extend a USD 150 million loan to Blinkit, which sparked more news about the possible merger.

For this year and the next, Zomato is ready to fund the losses. But, there is ‘an expectation, not guidance’, that Blinkit can achieve adjusted EBITDA break-even in less than three years.

Besides the opportunity for quick commerce startups to corner a large part of the USD 1 trillion commerce market in India, Deepinder Goyal gives three reasons why Blinkit is a high-margin business:

Higher average order value (AOV) than food delivery, higher ad sales revenue due to larger marketing budgets of consumer packaged products (CPG) brands, and lower last-mile delivery cost than food delivery with shorter delivery time and higher number of orders per day.

Goyal also reiterated that quick commerce has been Zomato’s stated priority since the last one year. Here’s a timeline of Zomato’s year-long pursuit of Blinkit (formerly Grofers):

June, 2021: Zomato turns Grofers into a unicorn

Throughout the month, as reports emerged about Zomato’s potential investment in Grofers, the e-grocery platform refused to confirm or deny the news, calling it ‘speculation’.

In the backdrop, competition in the grocery delivery space was intensifying with Grofer’s largest competitor Big Basket getting acquired by the Tata Group. Zomato’s rival Swiggy was aggressively building its hyper-local play with its own e-grocery service — Swiggy Instamart — after raising $1.25 billion in funding.

As expected, at the end of the month, Zomato led the USD 120 million funding round in Grofers at a valuation of USD 1 billion in exchange for nearly 10 percent stake. To be noted, Tiger Global — a common investor in both Zomato and Grofers — too participated in the round. However, most of the funds came from Zomato, which confirmed later that it had committed USD 100 million to Grofers in the unicorn round.

July, 2021: Grofers announces the Q-Commerce pivot

Zomato’s investment in Grofers had come just a month before the food delivery platform became one of India’s first new-age internet companies to list on the stock exchanges on July 23. For its part, Grofers took the fresh capital and forayed into what it called ‘instant deliveries’.

In a blog post on July 27, Grofers’ Co-Founder and CEO Albinder Dhindsa said, “Our work over the last 5 years allowed us the tools and the privilege of enabling an ecosystem that could promise to deliver groceries to every household in Gurgaon within 15 mins.”

In the pilot period, Grofers claimed to have delivered everyday essentials to over 7,000 households in Gurugram within 15 minutes though more than 900 delivery partners.

Our work over the last 5 years allowed us the tools and the privilege of enabling an ecosystem that could promise to deliver groceries to every household in Gurgaon within 15 mins.

Yesterday, over 7000 households experienced delivery within 15 mins. 🚀https://t.co/TbSD3l9A1y— Albinder Dhindsa (@albinder) July 27, 2021

Aug, 2021: Grofers starts 10-minute grocery deliveries

After Zomato’s investment in Grofers for nearly 10 percent stake received the approval of the monopoly watchdog Competition Commission Of India (CCI), the e-grocer pushed the limit and announced the start of 10-minute delivery of over 7,000 daily essentials in 10 cities.

“While our average delivery times are still hovering around the 15 minute mark, our eventual vision is to be below 10 minutes for every customer in India,” said Albinder Dhindsa, Co-Founder and CEO, Grofers.

However, as Grofers’ 10-minute delivery model received severe backlash on social media platforms over concerns that it risked the lives of delivery partners, Dhindsa came out with an explanation to address ‘the hate’.

I want to chime in about the hate we are getting for delivering groceries in 10 minutes... pic.twitter.com/RNhFvd6ojV

— Albinder Dhindsa (@albinder) August 28, 2021

Sept, 2021: Zomato pulls the plug on grocery delivery, Banks on Grofers

In an early warning sign of how tough running a Q-commerce model would prove to be, Zomato wrote to its grocery partners, saying it intends to stop its pilot grocery delivery service on September 17. The reasons: order fulfillment gaps, poor customer experience and intensely-fierce competition.

Zomato said, "We have decided to shut down our grocery pilot and as of now, have no plans to run any other form of grocery delivery on our platform.

Crucially, it added, “Grofers has found high quality product market fit in 10 minute grocery and we believe our investment in the company will generate better outcomes for our shareholders than our in-house grocery effort."

Nov, 2021: Zomato sees an ‘Inflection Point’ in Grofers’ 10-min model

As a part of its three-pronged long-term strategy, Zomato announced that it is going to build ‘the hyperlocal e-commerce ecosystem’ by investing and partnering with other companies to tap into growth beyond food, for which it planned to deploy USD 1 billion over 1-2 years.

In a blog post titled, ‘Inflection Point’, Zomato founder Deepinder Goyal said, “While we decided to not build quick-commerce on our platform, we are excited about the progress our partner company Grofers has made in the 10-min delivery space.”

Although there were reports that Zomato’s investment in Grofers was the first step towards a potential merger, Goyal for the first time stated his intentions. “As these businesses scale, we would want to be the provider of additional capital to these businesses and consolidate our stake leading to a potential merger at some point (at least in some cases, if and when the founders of these companies want to).”

December, 2021: Grofers rebrands itself to Blinkit for 10-min push

In a blogpost, Grofers announced that it is surging ahead as a new company with a new mission statement 'instant commerce indistinguishable from magic'.

“We will no longer be doing this as Grofers, we will be doing it as Blinkit," it said, with plans to take the total count of its dark stores across 12 cities to 350 by December in a greater push to deliver orders in about 10 minutes.

Here's why we are temporarily closing down areas without 10-minute delivery service. @letsblinkit pic.twitter.com/7LT79vNEJY

— Albinder Dhindsa (@albinder) December 20, 2021

At that time, Grofers said it had a three million monthly order run rate, experiencing 5x growth, gaining one million quick commerce users. Given the response, the e-grocer even closed down its operations in areas where it could not deliver in 10 minutes.

Grofers is now Blinkit.

Delivering your everyday essentials in a blink of an eye. @letsblinkithttps://t.co/27oH7lHHj3❤️💛 https://t.co/PYgLCixQZY— Deepinder Goyal (@deepigoyal) December 13, 2021

Feb, 2022: Deepinder Goyal’s bullishness on Blinkit

Amid reports that Zomato and Swiggy held talks with the heavily-funded Zepto, Deepinder Goyal expressed high confidence in Blinkit while providing the Q3FY22 update. “We made cash investments worth ~$225 million in the past year across three companies – Blinkit (erstwhile Grofers), Shiprocket and Magicpin – towards our objective of building out quick e-commerce in India.”

“Of these investments, Blinkit is the closest to how we all know the quick commerce business today. Blinkit pioneered 10-minute grocery delivery in India post our ~$100 million investment in August 2021,” said Goyal.

“100% of Blinkit’s business now is in quick commerce format with a median delivery time of ~12 minutes,” he added. “We are very bullish on the product-market fit, unit economics, as well as the growth trajectory of the quick commerce category.”

However, Deepinder Goyal’s personal investments in some of the startups that Zomato had begun to back had turned into a ‘conflict of interest’ issue.

Thanks @TVMohandasPai for raising an important question. Please see the attached note – hopefully, this will give you more confidence in the principles and processes of governance being followed at Zomato.

Next time, please tag me directly on such queries and skip @sbikh https://t.co/HtgpBdC6xy pic.twitter.com/MjLgQL3aoP— Deepinder Goyal (@deepigoyal) December 10, 2021

After selling his stake in one of Zomato’s investee companies Shiprocket, Goyal proceeded to sell his personal holdings in Blinkit to Tiger Global. As per reports, he had first invested about $94,000 in Grofers in 2015.

March, 2022: Zomato comes to Blinkit's rescue with $150 million loan

Despite Zomato's investment, Blinkit could not withstand the heat in the 10-minute delivery space, with the entry of deep-pocketed players such as Zepto. Dunzo had found the backing of Reliance Retail while Big Basket sheltered itself under Tata Group's umbrella.

Amid reports of Blinkit laying off employees, shuttering dark stores and delaying vendor payments, Zomato decided to extend a $150 million loan in one or more tranches. A week later, Zomato had its own fire to douse after it announced the launch of its 10-minute food delivery service — Zomato Instant.

While explaining the rationale behind the controversial move, Deepinder Goyal made a reference to Blinkit. “...After becoming a frequent customer of Blinkit (one of Zomato’s investments in the quick commerce space), I started feeling that the 30-minute average delivery time by Zomato is too slow, and will soon have to become obsolete. If we don’t make it obsolete, someone else will.”

May, 2022: Zomato answers the many questions on Blinkit

In its letter to shareholders with the Q4 earnings update, through the fictional character of Ms Savvy, Zomato put the big question to itself: “What is the plan with Blinkit? There are media reports of a potential M&A, is that true?”

To which Deepinder Goyal said, “We continue to remain bullish on quick commerce, especially given how synergistic it is to our core food delivery business, and are excited with the progress that Blinkit has made in this space.

“While there is a lot to do as the business is at its early stages, there’s still a lot of low hanging fruit to drive growth and efficiency,” he said.

“Blinkit has grown well in the past six months, and has also significantly reduced its operating losses. We have committed to give them a short term loan of up to $150 million to fund their short term capital needs.”

So, $150 million of short-term loan, is that already given out or that's yet to be given out? That was the question posed by a Goldman Sachs analyst during the earnings call.

Zomato’s CFO Akshant Goyal took the question and said, “Part of it is given out and part of it is pending. We'll see if they need it. We've committed to it, but whether we really give them the money or not is a function of whether they need it or not.”

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!